-

Published: Jan 16, 2026

Published: Jan 16, 2026

-

10 min. read

10 min. read

-

Summarize in ChatGPT

-

Maria Carpena

Maria Carpena Lead Emerging Trends & Research Writer

Lead Emerging Trends & Research Writer

- Maria is a Lead Emerging Trends & Research Writer at WebFX. With nearly two decades of experience in B2B and B2C publishing, marketing, and PR, she has authored hundreds of articles on digital marketing, AI, and SEO to help SMB marketers make informed strategic decisions. Maria has a degree in B.S. Development Communication major in Science Communication, and certifications in inbound marketing, content marketing, Google Analytics, and PR. When she’s not writing, you’ll find her playing with her dogs, running, swimming, or trying to love burpee broad jumps.

Table of Contents

- How target markets, segmentation, and ICPs work together

- The quarterly ICP refresh framework

- 1. Review recent customer data from the past quarter.

- 2. Evaluate ICP fit using consistent criteria

- 3. Decide what changes this quarter

- 4. Apply guardrails before narrowing

- 5. Align execution to the new ICP priorities

- 6. Review impact before the next refresh

- FAQs

- Quarterly ICP refreshes create a reliable decision rhythm. A repeatable review cadence helps teams reassess focus using current data and adjust priorities as conditions change.

- Target markets, segmentation, and ICPs play different roles. The target market defines scope, segmentation organizes it, and the ICP identifies which segments should receive priority in a given quarter.

- Seasonal B2B teams can use the framework to sequence focus across the year. Quarterly refreshes account for predictable demand shifts, allowing teams to adjust priorities without redefining fit.

The ideal customer profile (ICP) refresh operational framework is a short, repeatable review that uses recent customer data to confirm whether your current targeting priorities still make sense and where adjustments may be needed.

Enter the quarterly ICP refresh framework. This practical framework is a short, repeatable review that uses your recent customer data to confirm whether your current targeting still makes sense.

Below, we’ll walk through the framework and how your B2B team can incorporate it into your existing processes without turning ICP work into another long-term project:

- How target markets, segmentation, and ICPs work together

- The quarterly ICP refresh framework

- Why ICPs become outdated over time

- Why quarterly ICP refreshes work better than annual reviews

- Why narrowing your ICP feels risky

- How seasonal B2B businesses can use the quarterly ICP refresh framework

How target markets, segmentation, and ICPs work together

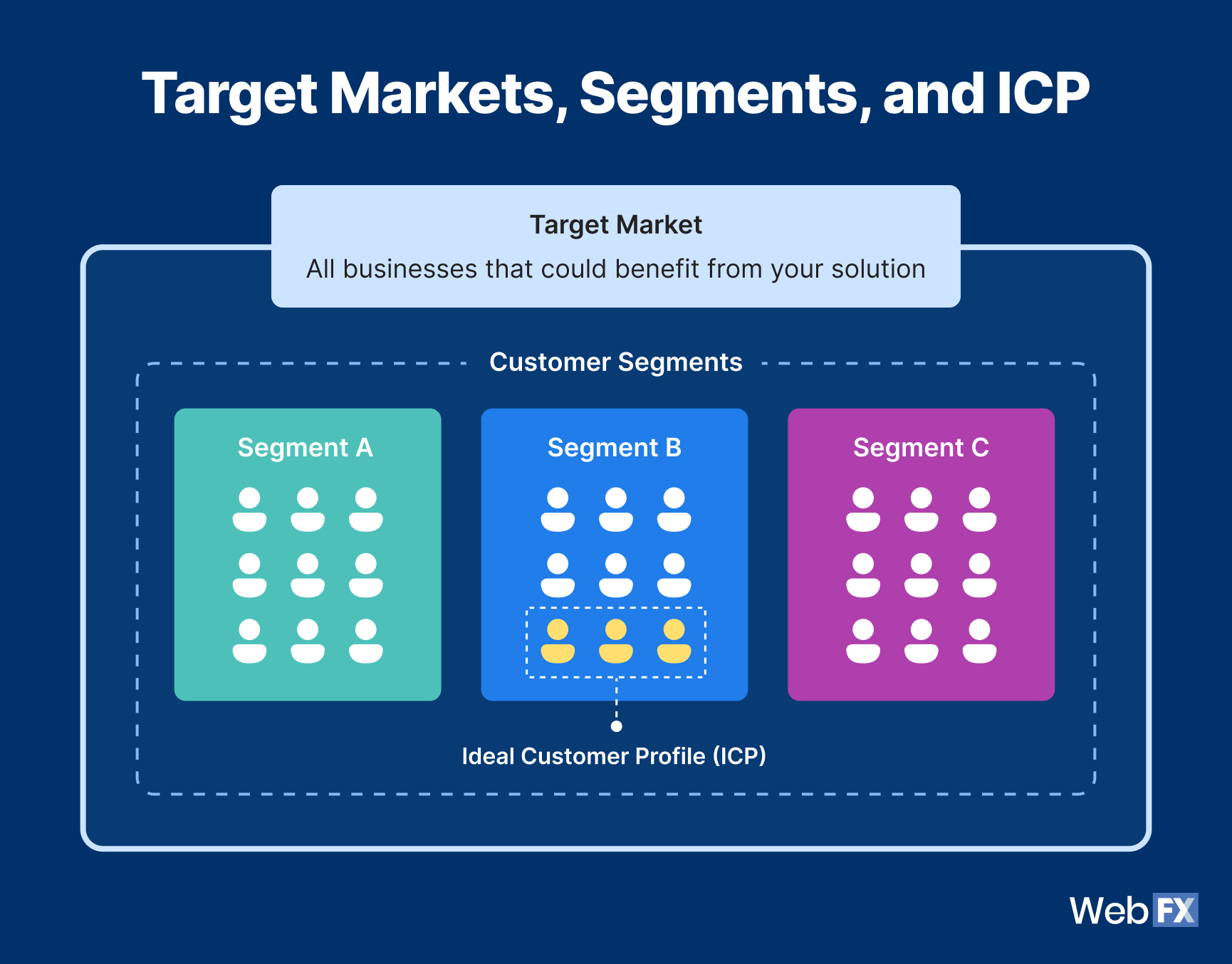

Many teams use “ICP” as shorthand for target market, customer segmentation, and personas. In practice, though, these concepts serve different purposes.

Understanding how they work together can help you avoid making your ICP too broad and identify which leads to prioritize.

Let’s clearly define each one to understand its importance for a B2B marketer:

Target market

Your target market refers to a group of businesses that likely need your product or service.

For example, let’s say you’re marketing SaaS for healthcare services, specifically an integrated electronic health record (EHR), patient portal, and appointment scheduling platform. You have a specific audience whose pain points you can address with your offering.

While your broad market is healthcare service providers, your target market could be smaller hospitals (not a hospital network) and medical practitioners who don’t need an enterprise-level platform.

In essence, your target market establishes boundaries and tells you who needs your products or services.

Customer segmentation

Customer segmentation breaks your target market into meaningful groups according to shared characteristics, such as organization type, size, geography, or behavior.

Using our example of the healthcare services SaaS, segmentation can look like this:

- Segment 1: Small hospitals in California

- Segment 2: Independent medical practitioners in California

- Segment 3: Small hospitals in Texas

- Segment 4: Independent medical practitioners in Texas

Segmentation helps B2B marketers understand how different groups behave, how their needs vary, and how buying dynamics differ.

ICP

Your ICP is a detailed description of your highest-value customer segments. It identifies which segments should receive priority based on fit and value.

Your ICP highlights the segments most likely to convert efficiently, retain over time, and align with business goals.

In the case of our sample healthcare services SaaS provider, let’s say medical practitioners in both California and Texas are high-value customers who renew their contracts annually. Meanwhile, other small hospitals in Texas churn after a few years when they expand, so they look for platforms with more features.

Based on these insights, you can determine which segments you want to focus on (medical practitioners in both California and Texas, and small hospitals in California), because they’ll likely become loyal customers.

That’s not to say you will stop entertaining inquiries from small hospitals in Texas. Instead, if you have prospects that fall under this segment, your sales team will know how to prioritize and approach them.

How to update your ICP: Quarterly refresh framework

This framework is designed to be simple enough to run regularly, but structured enough to produce real decisions. You can complete it in 60 to 90 minutes once per quarter.

The goal is to pause, look at recent data, and confirm whether your current focus still makes sense.

For seasonal B2B businesses, the quarterly refresh includes one important consideration. After using recent data from the past quarter to confirm fit, they must also set ICP priority based on which segments typically buy in the upcoming quarter. This lets sales and marketing teams align their efforts ahead of predictable changes in demand.

For example, a commercial cleaning company may know from previous years of data that office buildings typically book deep-cleaning services ahead of spring, while warehouses schedule work during winter slowdowns.

In that case, the quarterly refresh helps the team confirm both segments remain a good fit, then shift primary ICP focus based on which segment will be actively looking for their services in the upcoming quarter.

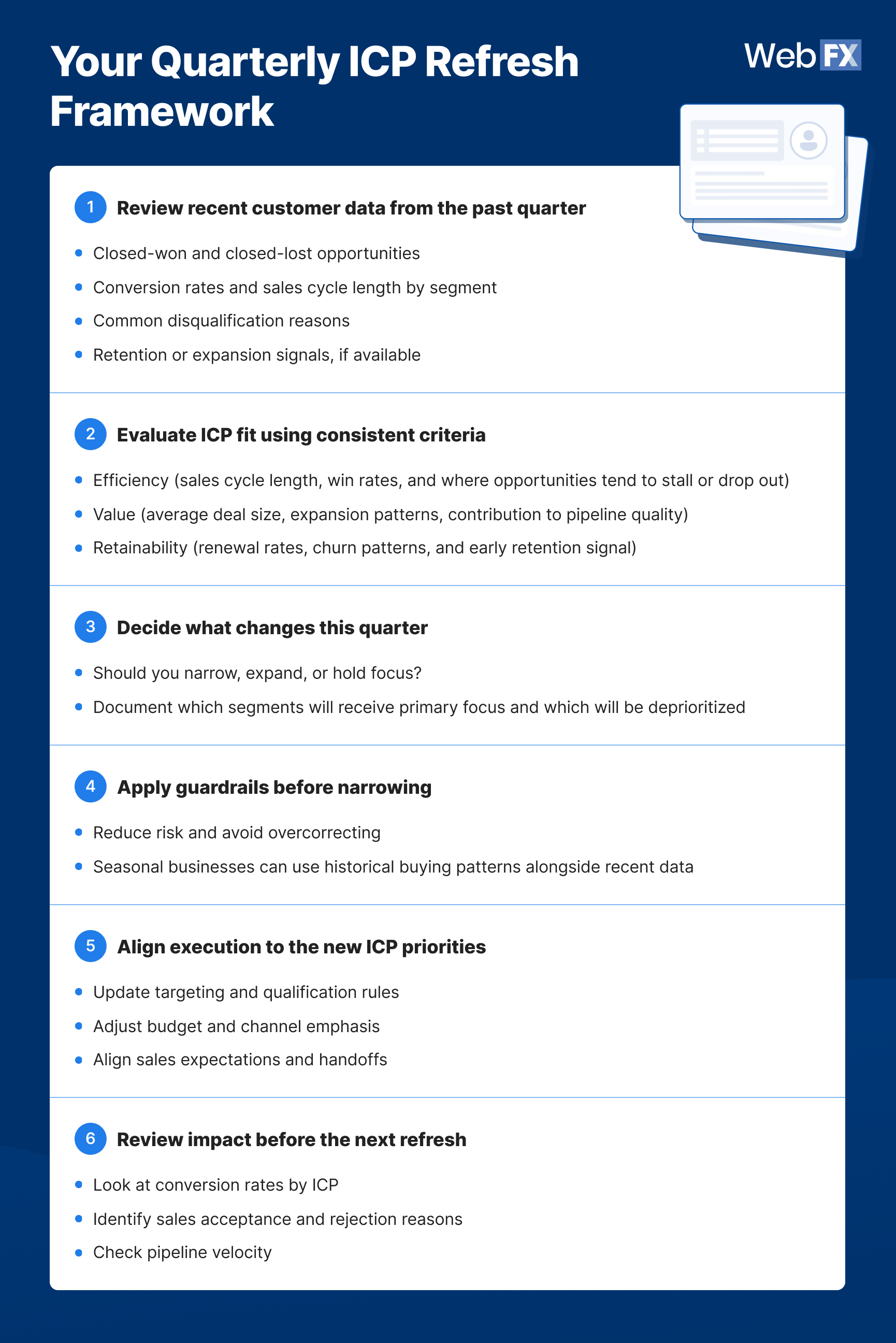

The quarterly ICP refresh framework

1. Review recent customer data from the past quarter.

Start by examining how your current segments performed over the last 90 days. The goal is to ground the conversation in recent, observable results before debating who your ideal customer should be.

Review:

- Closed-won and closed-lost opportunities

- Conversion rates and sales cycle length by segment

- Common disqualification reasons

- Retention or expansion signals, if available

At this stage, resist the urge to chase new markets or speculate about future opportunities. The focus is on understanding what’s happening within the segments you already serve.

For seasonal businesses, this review should be interpreted alongside historical data that reflects predictable shifts in demand.

2. Evaluate ICP fit using consistent criteria

With recent performance data in view, evaluate which segments have the strongest reason to engage with your product or service in the upcoming quarter.

Use the same criteria across segments, so comparisons stay grounded in observable signals. Focus on three areas:

Efficiency

How smoothly do deals move forward in this segment? Review each segment’s:

- Sales cycle length

- Win rates

- Where opportunities tend to stall or drop out

Value

Do opportunities in this segment support near-term revenue or longer-term growth? Look at the following:

- Average deal size

- Expansion patterns

- Contribution to pipeline quality

Retainability

Do customers in this segment stay and expand after purchase? Examine the following:

- Renewal rates

- Churn patterns

- Early retention signals

Applying these criteria consistently helps teams distinguish timing-related dips from meaningful shifts in demand and prioritize segments with both readiness and long-term potential.

3. Decide what changes this quarter

With recent data and fit signals in view, the next step is to make a clear prioritization decision for the upcoming quarter. Start by deciding how your ICP focus should shift, if at all.

Most teams will land in one of three places:

- Narrow focus to fewer segments showing stronger readiness or momentum

- Expand focus to include additional segments with emerging demand signals

- Hold current focus if results and conditions remain stable

Once the direction is set, document two things:

- Which segments will receive primary focus this quarter: These are segments showing clearer buying readiness, such as higher conversion rates, smoother sales cycles, fewer late-stage disqualifications, or increased sales-accepted activity relative to effort.

- Which segments will be deprioritized, even if they remain active: These segments may still convert, but show weaker timing signals or require more effort to move forward right now.

For seasonal businesses, this step often involves rotating priority rather than redefining fit. Segments that predictably convert during certain times of year may move into primary focus for the upcoming quarter, while others temporarily move down the list. The refresh makes those shifts explicit, so effort aligns with expected demand.

4. Apply guardrails before narrowing

Before narrowing your ICP, pause and apply a few guardrails. These guardrails help teams reduce risk and avoid overcorrecting based on short-term signals.

Start by checking three things:

- Does the revised focus support minimum pipeline needs? If narrowing significantly reduces reachable pipeline, adjust scope or retain a secondary segment that you can nurture to keep a healthy pipeline.

- Are observed trends consistent or driven by a single quarter? If performance shifts appear sudden or isolated, treat them as a signal to monitor rather than a reason to narrow aggressively. In these cases, maintain current focus while collecting another quarter of data.

- Is there a clear Core ICP and a defined Test ICP? The Core ICP represents the segments receiving the majority of your effort this quarter, while a Test ICP is a smaller, intentional allocation of effort toward a secondary segment used to validate assumptions or monitor emerging demand.

For seasonal businesses, use historical buying patterns alongside recent data. If a segment is expected to become active next quarter, retain it in the Core or Test ICP even if recent performance is soft.

5. Align execution to the new ICP priorities

Once ICP priorities are set, the next step is to ensure time, budget, and attention follow the decisions you just made.

Marketing and sales teams should be aligned as they face a new quarter with a shared understanding of where they’re focusing their efforts.

Start by making three adjustments:

Update targeting and qualification rules

Review how leads are being targeted, routed, and qualified. Confirm that primary ICP segments are acted upon quickly and evaluated against the right criteria, while deprioritized segments are still handled, but with adjusted expectations.

Adjust budget and channel emphasis

Reallocate spend and effort toward the channels and campaigns most likely to reach your primary ICP this quarter. Adjust your resources to reflect your priorities for the quarter.

Align sales expectations and handoffs

Make sure sales and marketing teams are aligned on which segments should be prioritized and why. Clarify how primary and secondary segments should be handled, including response timing, follow-up intensity, and qualification thresholds.

6. Review impact before the next refresh

Between refreshes, track a small set of signals to understand whether the new ICP priorities are working as intended. Focus on indicators that reflect movement:

- Conversion rates by ICP: Are primary segments moving through the funnel more efficiently than before?

- Sales acceptance and rejection reasons: Are fewer leads being disqualified late in the process? Are sales teams spending more time on the segments you intended to prioritize?

- Pipeline velocity: Is pipeline progressing at a steadier pace for primary ICP segments?

Success at this stage shows up as clearer patterns: smoother handoffs, fewer stalled opportunities, and better alignment between effort and results.

Document what improved, what stayed flat, and what raised new questions. Those observations become the inputs for the next quarterly refresh and help teams decide whether to maintain focus, adjust priorities, or test new segments.

For seasonal businesses, it helps to look at these signals alongside what you already know about your buying cycles. A slowdown in conversions or pipeline movement may simply reflect timing. In those cases, capture the pattern and use it to guide how priorities shift next quarter, instead of treating it as a problem that needs immediate correction.

FAQs

Why do ICPs become outdated over time?

Your ICPs rarely become inaccurate overnight. A lot of factors affect your buyers’ behavior, including (but not limited to) the following:

- Industry changes

- Budget adjustments

- Customer mix changes

- Evolution of buying committees and sales cycles

Over time, these changes affect who converts well and why. An ICP that once aligned closely with high-quality demand can drift without anyone noticing.

When left unchecked, your static ICP that was once your guiding light that helped you close contracts will eventually become stale. The practice of creating ICPs during annual planning and revisiting it when performance declines is no longer — shall we say — best practice.

Instead of having a reactive approach, B2B companies can proactively set a clear cadence for refreshing ICPs and have a dedicated owner of ICP updates backed by data and not just hunches.

Why do quarterly ICP refreshes work better than annual reviews?

Once your target markets and segments are clearly defined, the central question for an ICP becomes prioritization. Which segments should receive primary focus right now?

Cadence then determines how often that prioritization is revisited. Annual ICP reviews often rely on data that no longer reflects current buying conditions. As markets shift, teams may still be processing insights that were accurate months ago but are less informative today.

A quarterly refresh introduces a workable rhythm. It gives teams a regular opportunity to reassess focus using recent customer data without revising foundational strategy or reacting to short-lived changes.

Importantly, refreshing an ICP does not mean abandoning other segments. Secondary segments can remain active, and sales can continue engaging inbound interest outside the core ICP. The refresh simply helps teams decide what to prioritize for the next quarter.

Is narrowing my ICP risky for my business?

Narrowing your ICP can feel like closing doors on other potential clients or limiting your pipeline. This concern is understandable, especially for B2B teams that are under pressure from management to generate revenue.

As a result, ICPs typically stay broad to preserve optionality. However, keeping your ICP broad creates new problems over time:

- Targeting and messaging lose focus. When an ICP tries to include everyone, your marketing messages become less relevant to your core audience. High-value prospects are harder to engage because your messages aren’t tailored to their priorities. As a result, you lose rapport and interest from your most valuable prospective clients.

- Lead scoring becomes harder. Prioritizing all your customer segments makes it harder for your sales teams to focus on nurturing leads that are most likely to convert. Instead, they’re spending the same amount of time and effort on leads that may not even be qualified.

- Conversion rates dip. Because you miss out on moving your most valuable prospects closer to purchase, your conversion rates can potentially decrease.

A quarterly refresh reframes narrowing as a reviewable and adjustable decision. You can review and measure results, make adjustments, and expand focus when needed.

How can seasonal B2B teams use the quarterly ICP refresh framework?

Many B2B businesses operate in predictable cycles, where demand shifts throughout the year based on budgets, operating schedules, or industry rhythms. In those environments, the quarterly ICP refresh helps teams manage focus intentionally across seasons.

For seasonal teams, the framework is used to sequence priorities. Here’s how it typically shows up in practice:

Review recent data alongside historical patterns

This helps teams separate seasonal timing effects from real performance changes. Looking at both together prevents overreacting to predictable slow periods.

Confirm fit, then set quarterly priority

This step reinforces that fit remains stable even as demand shifts. Priority is set based on which segments are most likely to engage in the coming quarter, allowing teams to focus effort where it’s most effective.

Rotate focus without rewriting the ICP

Quarterly focus can change without redefining who the business serves. This keeps the ICP consistent while giving teams flexibility to respond to seasonal demand cycles.

Interpret results before making structural changes

Seasonal dips are captured as signals to learn from. Those observations inform the next refresh and support more measured, confident decisions over time.

For seasonal B2B teams, the quarterly ICP refresh provides a steady way to plan ahead, adjust focus every quarter, and keep sales and marketing aligned throughout the year.

What changes when ICPs become a system

Treating ICPs as a repeatable system empowers teams to make focused decisions over time.

Instead of relying on occasional updates or gut checks, B2B teams establish a rhythm for reviewing data, setting priorities, and adjusting execution. That rhythm reduces ambiguity. Targeting becomes more consistent, and sales and marketing stay aligned around the same segments and expectations.

Because the process repeats each quarter, adjustments are made intentionally and measured against the right signals. Sales and marketing teams revisit decisions with context, rather than reacting to short-term swings or one-off results.

Over time, the refresh becomes routine. Teams spend less time re-debating which segments to prioritize and more time focusing on what matters most in a given quarter.

With a clear process for identifying Core and Test ICPs, teams can direct more effort toward improving how they nurture and retain the segments that matter most.

-

Maria is a Lead Emerging Trends & Research Writer at WebFX. With nearly two decades of experience in B2B and B2C publishing, marketing, and PR, she has authored hundreds of articles on digital marketing, AI, and SEO to help SMB marketers make informed strategic decisions. Maria has a degree in B.S. Development Communication major in Science Communication, and certifications in inbound marketing, content marketing, Google Analytics, and PR. When she’s not writing, you’ll find her playing with her dogs, running, swimming, or trying to love burpee broad jumps.

Maria is a Lead Emerging Trends & Research Writer at WebFX. With nearly two decades of experience in B2B and B2C publishing, marketing, and PR, she has authored hundreds of articles on digital marketing, AI, and SEO to help SMB marketers make informed strategic decisions. Maria has a degree in B.S. Development Communication major in Science Communication, and certifications in inbound marketing, content marketing, Google Analytics, and PR. When she’s not writing, you’ll find her playing with her dogs, running, swimming, or trying to love burpee broad jumps. -

WebFX is a full-service marketing agency with 1,100+ client reviews and a 4.9-star rating on Clutch! Find out how our expert team and revenue-accelerating tech can drive results for you! Learn more

Try our free Marketing Calculator

Craft a tailored online marketing strategy! Utilize our free Internet marketing calculator for a custom plan based on your location, reach, timeframe, and budget.

Plan Your Marketing Budget

Table of Contents

- How target markets, segmentation, and ICPs work together

- The quarterly ICP refresh framework

- 1. Review recent customer data from the past quarter.

- 2. Evaluate ICP fit using consistent criteria

- 3. Decide what changes this quarter

- 4. Apply guardrails before narrowing

- 5. Align execution to the new ICP priorities

- 6. Review impact before the next refresh

- FAQs

Proven Marketing Strategies

Proven Marketing Strategies

Try our free Marketing Calculator

Craft a tailored online marketing strategy! Utilize our free Internet marketing calculator for a custom plan based on your location, reach, timeframe, and budget.

Plan Your Marketing Budget

What to read next