- Home

- Blog

- Manufacturing

- 2025 Manufacturing Marketing Benchmarks Every Industrial Firm Must Track

2026 Manufacturing Marketing Benchmarks Every Industrial Firm Must Track

-

Published: Sep 10, 2025

Published: Sep 10, 2025

-

12 min. read

12 min. read

-

Summarize in ChatGPT

-

Albert Dandy Velasquez

Albert Dandy Velasquez Content Specialist

Content Specialist

- Albert Dandy Velasquez blends SEO strategy with compelling storytelling to help businesses boost their visibility and revenue online. With a B.A. in English and certifications from HubSpot, Semrush, and Google Analytics, he has written and optimized hundreds of articles on organic SEO, content strategy, and user experience. He regularly contributes to the WebFX blog and SEO.com, creating content that helps readers turn marketing goals into measurable results. When he’s off the clock, he’s usually exploring new neighborhoods on two wheels, filming travel content, or chasing golden hour with a coffee in hand.

Table of Contents

- What are manufacturing marketing benchmarks (and why do they matter)?

- Key manufacturing marketing benchmarks you should track

- 💡 What these numbers mean for manufacturers

- 🎯 Spending too much for leads or clicks? Try these moves:

- 💡 How these metrics shape your funnel

- 💡 What this signals for your positioning

- 💡 What the data is really saying

- 💡 Where you win (or waste) budget

- FAQs about manufacturing marketing benchmarks

- Power your pipeline with benchmark-driven marketing

- Data sources & methodology

TL;DR: What are manufacturing marketing benchmarks?

Manufacturing marketing benchmarks are performance metrics that help manufacturers evaluate how well their marketing efforts are delivering results compared to industry standards. These benchmarks give you the yardstick you need to set smarter goals, refine strategies, and stay competitive.

Here’s what strong manufacturing marketing performance looks like:

- Cost per lead (CPL): $263 (B2C) / $377 (B2B)

- Conversion rate (CVR): 2.75% average

- Sales cycle length: 158 days average

- Cost per click (CPC): $5.16 average in 2024

- Gross margin: 26.9% for B2B manufacturers

Tracking these industrial marketing benchmarks helps you uncover underperforming areas, optimize campaigns, and make smarter strategy and budget decisions.

You’ve poured time, budget, and brainpower into marketing and still, the results feel… meh. You’ve tried paid ads, sent newsletters, posted on LinkedIn, and crossed your fingers, hoping something sticks. But leads trickle in, conversions stall, and leadership wants numbers you can’t confidently defend. The problem isn’t effort, it’s clarity. You don’t need more guesswork. You need proof.

That’s what manufacturing marketing benchmarks deliver. These are the hard numbers that separate the noise from what’s actually moving the needle. No fluff, just facts. Once you know where you stand, you’ll know exactly where to double down, what to fix, and how to make marketing feel like a growth engine again (not a gamble).

What are manufacturing marketing benchmarks (and why do they matter)?

| Only 20% manufacturing marketers reported that their marketing strategy is effective. Tracking the right manufacturing marketing benchmarks helps close that huge gap. |

Manufacturing marketing benchmarks are your cheat codes in a complex, high-stakes game. Without them, you’re making big budget decisions with a blindfold on. These aren’t just nice-to-know metrics; they’re the proof points that tell you if your strategy’s working, where you’re leaving money on the table, and what needs to shift. In an industry where sales cycles can stretch for months and marketing teams are often small, having benchmarks gives you a control panel to steer smarter.

Here’s why benchmarks are especially valuable for manufacturers:

- Spot blind spots in your funnel before they drain your pipeline

- Set realistic KPIs based on actual industry performance, not guesses

- Track ROI across long, multi-touch sales journeys

- Prioritize high-impact channels that convert and cut the ones that don’t

- Win internal buy-in by backing strategy with hard data

If you’re not tracking performance with benchmarks, you’re stuck with gut feelings. And in today’s competitive market, that’s a risk you can’t afford.

Key manufacturing marketing benchmarks you should track

Knowing your numbers is the difference between guessing and growing. Our analysis of proprietary data from 35+ manufacturing categories exposes the critical benchmarks that separate top performers from the rest.

These manufacturing marketing metrics give you the clarity to evaluate performance, detect leaks, and drive better results across your funnel. Here’s a breakdown of the most important manufacturing marketing benchmarks to measure and optimize:

Manufacturing marketing benchmarks snapshot

Think your marketing performance is “okay”? Let’s put that to the test. This manufacturing marketing benchmark snapshot gives your numbers the context they need, and shows how key sectors are performing right now.

It’s hard to steer strategy without knowing how your performance stacks up. Use this high-level view to spot opportunities, flag inefficiencies, and build a smarter path toward ROI.

| Metric | Industry Values |

| CPL (B2B) |

|

| CPL (B2C) |

|

| Website CVR |

|

| Sales cycle |

|

| Gross margin (B2B) |

|

| CPC (2024) |

|

1. Lead generation cost & efficiency benchmarks

In manufacturing, every dollar you spend to capture a lead tells a story. These manufacturing marketing benchmarks reveal if your lead generation engine is firing on all cylinders or leaking profit with every click. Two of the most important manufacturing marketing metrics, cost per lead (CPL) and cost per click (CPC), show you where your budget stands against industry norms and whether you’re investing in growth or overspending for scraps.

Manufacturing CPL range

| Range | CPL (B2C) | CPL (B2B) |

| Low end | $58–$63 | $82–$103 |

| Mid range | $178–$333 | $171–$333 |

| High end | $396–$686 | $779–$1,055 |

Manufacturing CPC range

| Manufacturing segment | CPC | Market type |

| Software/Technology | $15-35 | Premium market |

| Heavy industrial | $8-12 | Established market |

| Specialized/Niche | $5-10 | Targeted market |

| Automotive/Consumer | $3-6 | Volume market |

💡 What these numbers mean for manufacturers

High CPLs often point to complex, high-value products with longer sales cycles, where a $700 lead can still deliver excellent ROI. Low CPLs, on the other hand, usually reflect high-volume, price-sensitive consumer products, where efficiency is everything.

CPC ranges tell you how competitive the click auction is in your market. High CPCs in premium segments like software and industrial automation may look expensive, but they also signal lucrative, high-margin opportunities. Low CPCs in consumer categories point to crowded, price-driven markets where differentiation is critical.

Put simply, CPL shows you what it costs to get a foot in the door, while CPC reveals how hard competitors are pushing to get in front of the same buyers. Together, these industrial marketing benchmarks give you the clearest picture of your lead generation efficiency.

🎯 Spending too much for leads or clicks? Try these moves:

If your CPL or CPC is higher than industry norms, don’t panic. Here are actionable strategies manufacturers can use to optimize lead generation performance without sacrificing quality:

Refine audience segments:

Use firmographic filters and lookalike audiences to zero in on higher-intent buyers.

Retool ad creative:

Benefit-driven, specific messaging outperforms generic slogans. Show buyers exactly how your solution solves their pain points.

Prioritize high-ROI channels:

Double down on the campaigns and platforms generating qualified leads, and cut back on underperformers.

Strengthen your offers:

Test demos, ROI calculators, or free tools instead of static “Contact Us” CTAs to boost conversion.

Shorten the funnel:

Automate lead qualification and routing to improve conversion rate (CVR) and reduce wasted spend.

2. Sales cycle & conversion benchmarks

Not all manufacturing leads move at the same speed (and not all of them convert). Some buyers close in a matter of days. Others take months of nurturing, approvals, and cross-team coordination. That’s why tracking sales cycle and conversion rate (CVR) is a critical part of any data-driven manufacturing marketing strategy.

These two manufacturing marketing metrics provide the clearest view into where your pipeline slows down, how efficiently your funnel moves qualified leads, and what your team can realistically expect in terms of revenue generation.

Sales cycle range

| Range | Sales cycle | Sub-sector |

| Short cycles | 1–7 days |

|

| Medium cycles | 30–180 days |

|

| Long cycles | 365+ days |

|

Conversion rate range

| Tier | CVR | Sub-sector |

| High performers | 6%+ |

|

| Industry average | 3-5% |

|

| Challenges | <2% |

|

💡 How these metrics shape your funnel

Sales cycle and CVR benchmarks reveal your market reality. A long sales cycle might not always mean poor marketing. It could also mean your offering involves more technical review, budget approvals, or compliance steps. On the other hand, a low conversion rate might point to misaligned messaging, trust gaps, or friction in your follow-up process.

The key is context. In food and beverage manufacturing, 90-day pipelines and sub-1% CVRs might be common. In medical equipment, a 6-month sales cycle with a 7% close rate could be standard. Understanding how these manufacturing marketing benchmarks vary across sectors helps you set business goals that are realistic (not random).

By using these manufacturing marketing metrics to calibrate objectives, optimize handoffs, and time outreach correctly, you’ll improve not just your marketing performance, but you’ll create a pipeline that actually performs under pressure.

🎯 Shrink your sales lag & lift your close rates with these tactics:

Want to improve pipeline velocity and deal conversion without breaking your budget? These strategies help manufacturers close the loop between interest and action:

Support long-cycle buyers with value content:

Use nurture flows, decision-stage content, and comparison tools to stay top-of-mind during lengthy B2B buying processes.

Strengthen sales handoff processes:

Make sure reps receive context-rich lead intel (not just names and emails) to reduce drop-off and boost engagement.

Eliminate dead zones in follow-up:

Automate check-ins, reminders, or demo invites so momentum doesn’t stall mid-funnel.

Increase perceived trust and value:

Use case studies, data sheets, and testimonial content to validate your offer and reduce objections.

Track where conversions stall:

Use lead attribution and conversion tracking to identify common drop-off points and plug the leaks.

3. SEO & keyword performance benchmarks

Search behavior in manufacturing is both competitive and complex. Our analysis of Ahrefs keyword data across high-impact manufacturing terms spotlights where the opportunities and the challenges lie. Having a good grasp of the industry’s keyword landscape helps you prioritize where your SEO budget works hardest.

High-volume manufacturing keywords

| Keyword | Monthly volume | Difficulty | Traffic potential |

| manufacturing software | 10,000 | 21 | 8,000 |

| industrial equipment | 11,000 | 73 | 62,000 |

| heavy machinery | 4,700 | 37 | 5,300 |

| metal fabrication | 4,700 | 33 | 1,900 |

| construction machinery | 2,900 | 58 | 5,300 |

| automotive parts | 2,200 | 95 | 1,700,000 |

| aerospace manufacturing | 1,800 | 74 | 500 |

| food manufacturing | 1,600 | 43 | 250 |

Search intent & difficulty insights

| Competition tier | Difficulty range | Sector examples |

| Low | 0-30 |

|

| Medium | 31-60 |

|

| High | 61-100 |

|

📊 Quick takeaways:

- 70% of manufacturing keywords carry both commercial and informational intent, meaning content must educate and sell.

- High-value keywords like medical devices manufacturing show strong buying intent with CPCs over $5.00.

- Niche opportunities exist in lower-competition areas like chemical processing (Difficulty: 12), where smaller players can gain visibility quickly.

Reddit community insights

| Challenges | Insights |

| Digital transformation gaps |

|

| Lead generation struggles |

|

| Tech adoption hurdles |

|

| Market conditions impact |

|

Reddit B2B marketing insights

| What’s working | What’s not |

| LinkedIn personal branding over company pages (CEO profiles generate 10x engagement) | Over-reliance on AI automation without human connection |

| Productized service offerings (“hire offshore employee for $99/week”) | Video content underperforming expectations |

| Slideshows + visual posts outperforming links | External link sharing reducing organic reach |

| Network growth through professional groups and direct outreach |

💡 What this signals for your positioning

The manufacturing SEO space is vast and uneven. Ultra-competitive keywords like “automotive parts” come with sky-high CPCs and difficulty scores, while niche terms like “chemical processing” offer underutilized search potential. But data alone doesn’t tell the full story.

Reddit threads across r/manufacturing and r/b2bmarketing echo a familiar frustration: Low digital ROI, long lead times, and skepticism around modern marketing tools. This sentiment reveals the why behind the what, and the disconnect between what manufacturers are searching for and what actually delivers.

If you’re optimizing solely by volume or keyword difficulty, you’re missing real buying signals. Smart SEO in manufacturing requires blending intent with opportunity, and layering keyword data with what the industry is saying in its own words.

🎯 Capitalize on these insights with these proven strategies:

Here’s how to turn keyword data + Reddit sentiment into strategic action:

Balance long-tail and high-volume terms:

Focus on keywords with attainable difficulty and strong buyer intent — not just the ones with the biggest numbers.

Layer SEO with community-driven insights:

If real buyers talk about MES or delivery problems, create content that addresses those pain points.

Use social proof content in tandem with SEO:

Add testimonials, data sheets, and process visuals to your highest-performing organic pages.

Don’t ignore branding SEO:

Threads show that company and executive visibility on LinkedIn drives more engagement than company posts alone.

Publish where conversations happen:

Repurpose SEO content into LinkedIn slideshows or Reddit replies to extend its reach.

4. Content strategy & publishing benchmarks

Content in manufacturing is your brand’s secret weapon. High-value content educates technical buyers, nurtures leads during long sales cycles, and positions your brand as an industry authority. But not all content types perform equally well, and your publishing frequency can make or break momentum.

High-performing content types

| Content type | Key focus areas | Benefit |

| Technical documentation & guides |

|

Builds trust with technical buyers and supports post-sale satisfaction |

| Case studies & applications |

|

Proves value and de-risks buying decisions |

| Industry news & trends |

|

Keeps your brand relevant and top-of-mind |

Publishing frequency recommendations

| Manufacturing segment | Recommended frequency | Purpose |

| Manufacturing software companies | 3-4 posts/week | Maintain visibility in fast-moving tech spaces |

| Industrial equipment suppliers | 2-3 posts/week | Capture high-intent searchers with consistent updates |

| Specialized manufacturing | 1-2 posts/week | Deep-dive, technical content to attract niche buyers |

| Service providers | Daily posting | Drive thought leadership and networking engagement |

Content is a traffic lever and a conversion catalyst for manufacturing companies. Since the buyer’s journey is often complicated and technical, content serves as both educator and salesperson. High-value content (like guides, case studies, and trend commentary) builds authority with search engines and buyers. But inconsistent publishing or the wrong content type can stall momentum. Anyone can publish content. But smart brands publish with purpose and consistency, and watch it pay off. Content velocity is all about compounding authority. Consistently publishing valuable, technical content fuels search engine optimization (SEO), accelerates lead nurturing, and keeps your brand in front of decision-makers when they’re ready to buy. 🎯 Need content that converts? Focus on these fixes: Here’s how to turn content benchmarks into real pipeline growth: Invest in technical documentation and case studies to shorten sales cycles and reduce buyer hesitation. If you’re in a fast-moving space like manufacturing software, publish more often to stay visible and relevant. Repurpose one blog post into a video demo, LinkedIn carousel, gated PDF, and follow-up email to maximize ROI. Especially for specialized manufacturing, create long-form, data-backed content that shows technical credibility. Use content to respond quickly to regulatory changes, supply chain updates, or tech disruptions to stay top-of-mind.💡 What the data is really saying

Prioritize high-trust formats:

Map frequency to buyer expectations:

Build a content flywheel:

Focus on depth over fluff:

Stay tuned to industry shifts:

5. Competitive landscape insights

The manufacturing industry is a mosaic of highly specialized niches, each with its own competitive dynamics, keyword opportunities, and sales realities. Understanding where your sector sits in this field is critical to crafting a marketing strategy that wins market share without overspending.

Manufacturing software market

- High CPC/Competition: Indicates a mature, profitable market

- Growth Opportunity: Lower difficulty (21) suggests content marketing potential

- Strategy: Focus on educational content and thought leadership

Industrial equipment sector

- Massive Traffic Potential: 62K monthly traffic suggests a strong organic opportunity

- Pricing Pressure: Low CPC ($0.20) indicates a competitive pricing environment

- Approach: Volume-based content strategy required

Specialized manufacturing

- Aerospace/Medical: High margins reflected in longer sales cycles and higher CPCs

- Chemical Processing: Untapped opportunity with low competition

- Heavy Equipment: Balanced opportunity with moderate competition and good traffic potential

💡 Where you win (or waste) budget

Manufacturing isn’t one-size-fits-all, and neither is your marketing strategy. What works for high-CPC software brands won’t move the needle for a niche chemical processor or an equipment distributor with razor-thin margins. These competitive insights reveal where your sector is positioned on the digital playing field, and what it will cost to win attention.

Some segments thrive on scale, others on specialization. Knowing your market’s CPC dynamics, traffic ceilings, and keyword difficulty helps you avoid overspending in saturated spaces and double down where your brand can win with smarter content, not just a bigger budget.

🎯 Gain competitive ground with these power plays:

For manufacturing software companies

Build trust before the first click.

- Invest in thought leadership content (guides, whitepapers, expert insights).

- Use SEO to reduce reliance on paid ads in a high-CPC space.

- Publish demo videos and onboarding flows to de-risk adoption.

For industrial equipment suppliers

Go wide, then go deep.

- Create scalable SEO content that targets mid-funnel keywords with buyer intent.

- Leverage FAQs, specs sheets, and comparison pages to capture long-tail queries.

Build internal linking systems to increase topical authority.

For specialized/niche manufacturers

Precision > volume.

- Focus on in-depth, high-authority technical content.

- Use ABM-style content (custom case studies, ROI calculators) to warm high-stakes leads.

- Target emerging, low-competition keywords (e.g., chemical processing) for early-mover advantage.

Strategic recommendations for manufacturing marketing

Turning benchmark insights into action is where real growth happens. Aligning your strategy with proven manufacturing marketing performance data ensures every dollar drives measurable results. Here are high-impact recommendations tailored to the unique realities of manufacturing:

Segment-specific strategies

| Segment | Key trait | Recommended approach | CPL target |

| High-value, long-cycle products (Aerospace, heavy equipment) | 12+ month sales cycles (extended nurture campaigns) |

|

$500–$1,000+ |

| Mid-market manufacturing (Industrial, construction) | 3–6 month nurture cycles |

|

$200–$500 |

| High-volume, low-margin (Automotive, consumer products) | Short sales cycles with quick decision points |

|

$100–$300 |

Digital marketing priority matrix

| Timeframe | Top priorities |

| Immediate priorities |

|

| Medium-term investments |

|

| Long-term strategic initiatives |

|

Recommended marketing spend by revenue

| Manufacturing segment | Revenue | Marketing spend |

| Small manufacturers | <$10M | 3-5% of revenue |

| Mid-Size manufacturers | $10-100M | 4-6% of revenue |

| Large manufacturers | >$100M | 2-4% of revenue |

Recommended channel distribution

| Channel | Allocation |

| Digital marketing | 40-60% |

| Trade shows/Events | 20-30% |

| Sales enablement | 15-25% |

| Brand/PR | 5-15% |

FAQs about manufacturing marketing benchmarks

What are manufacturing marketing benchmarks?

Manufacturing marketing benchmarks are measurable performance metrics that help manufacturers evaluate the effectiveness of their marketing efforts. These benchmarks give you a baseline to compare performance across lead generation, sales efficiency, and ROI, so you know where to scale, optimize, or pivot.

These manufacturing marketing metrics include:

- Cost per lead (CPL): $263 (B2C) / $377 (B2B)

- Conversion rate (CVR): 2.75% average

- Sales cycle length: 158 days average

- Cost per click (CPC): $5.16 average in 2024

- Gross margin: 26.9% for B2B manufacturers

Tracking these industrial marketing benchmarks helps you align your strategy with industry standards and outperform the competition.

How often should manufacturers review their marketing benchmarks?

Manufacturers should review key marketing benchmarks at least quarterly to spot trends, adapt to market changes, and stay competitive. In fast-moving sectors like manufacturing software or industrial equipment, a monthly review may be necessary to keep campaigns agile. Regular analysis ensures you can adjust targeting, reallocate budget, and refine messaging before performance gaps widen.

Do smaller manufacturers need to track benchmarks too?

Absolutely. Industrial marketing benchmarks aren’t just for Fortune 500s. They’re especially valuable for small and mid-sized manufacturers trying to compete smarter.

If you’re a lean team with a tight budget, tracking marketing performance helps you:

- Prioritize low-hanging fruit (e.g., local SEO, niche keywords)

- Optimize your cost-per-lead with smarter targeting

- Build a repeatable system that doesn’t rely on trade shows or word-of-mouth

Benchmarks let smaller players punch above their weight and gain share in overlooked digital channels.

What’s a good cost per lead (CPL) for manufacturing marketing?

The “good” CPL for manufacturing depends on your sector, product complexity, and whether you sell B2B or B2C. Based on the latest data:

- B2B manufacturing CPLs range from $82–$1,055 (low to high end)

- B2C manufacturing CPLs range from $58–$686 (low to high end)

Higher CPLs aren’t always bad, especially if you sell high-value, long-cycle products like aerospace components.

How can manufacturers lower their cost per lead (CPL)?

Here’s how to reduce CPL while maintaining lead quality:

- Tighten your targeting: Use long-tail keywords and negative keywords in pay-per-click (PPC)

- Invest in SEO: Rank for niche, low-difficulty keywords your competitors ignore

- Improve UX: Fast-loading, persuasive landing pages drive more conversions

- Use sales enablement content: Whitepapers, case studies, and pricing guides help move serious buyers forward

- Add remarketing: Re-engage warm visitors with high-intent offers

- Align with sales: Make sure sales is ready to close leads marketing brings in

When manufacturing marketing performance improves, so does your bottom line without inflating your ad budget.

How do industrial marketing benchmarks differ between B2B and B2C?

B2B industrial marketing benchmarks typically show higher CPLs and longer sales cycles due to complex buying committees and higher-value orders. B2C manufacturing often has shorter sales cycles, lower CPLs, and higher transaction volume. For example, automotive services (B2C) can close deals in a day, while aviation contracts (B2B) may take 12+ months.

Can benchmarks help manufacturers compete in high-CPC markets?

Yes. In high-CPC manufacturing markets like software ($15–$35 CPC), benchmarks help you gauge whether your cost aligns with industry norms and profitability goals. By comparing your CPC, CVR, and CLV to industry averages, you can decide if a market’s high CPC is justified or if you should focus on lower-cost, niche keywords where ROI may be stronger.

Power your pipeline with benchmark-driven marketing

You’ve seen how top manufacturers measure success; now it’s your turn to turn benchmarks into bragging rights. Tracking the right manufacturing marketing benchmarks provides you with the clarity to cut waste, sharpen targeting, and scale with precision.

Feeling overwhelmed or unsure where to start? You don’t have to figure it all out alone.

At WebFX, we help manufacturing businesses like yours turn data into decisions, and decisions into real ROI. With 34M+ qualified leads delivered and $4.9B+ in revenue generated for manufacturing companies, our manufacturing marketing agency has built full-funnel strategies that outperform the industry average.

You already have the benchmarks, now let’s build a pipeline your competitors wish they had. Get your free proposal or call 888-601-5359 to speak with a manufacturing marketing strategist today!

Data sources & methodology

Our findings combine quantitative and qualitative insights to create a benchmark framework manufacturers can trust:

Proprietary data

Analysis of 35+ manufacturing sub-industries, including cost metrics, conversion rates, and operational benchmarks from a verified industry database.

Ahrefs intelligence

Keyword research covering 10 primary manufacturing categories with search volume, competition, and CPC data for the US market.

Reddit community analysis

Qualitative insights from r/manufacturing (40+ discussions), r/B2BMarketing (50+ discussions), and related communities focusing on real-world challenges and successful strategies.

Report limitations

Data reflects primarily US market conditions. International markets may show different patterns. Seasonal variations were not fully captured in this analysis.

Report compiled

July 2025

Next update

October 2025

-

Albert Dandy Velasquez blends SEO strategy with compelling storytelling to help businesses boost their visibility and revenue online. With a B.A. in English and certifications from HubSpot, Semrush, and Google Analytics, he has written and optimized hundreds of articles on organic SEO, content strategy, and user experience. He regularly contributes to the WebFX blog and SEO.com, creating content that helps readers turn marketing goals into measurable results. When he’s off the clock, he’s usually exploring new neighborhoods on two wheels, filming travel content, or chasing golden hour with a coffee in hand.

Albert Dandy Velasquez blends SEO strategy with compelling storytelling to help businesses boost their visibility and revenue online. With a B.A. in English and certifications from HubSpot, Semrush, and Google Analytics, he has written and optimized hundreds of articles on organic SEO, content strategy, and user experience. He regularly contributes to the WebFX blog and SEO.com, creating content that helps readers turn marketing goals into measurable results. When he’s off the clock, he’s usually exploring new neighborhoods on two wheels, filming travel content, or chasing golden hour with a coffee in hand. -

WebFX is a full-service marketing agency with 1,100+ client reviews and a 4.9-star rating on Clutch! Find out how our expert team and revenue-accelerating tech can drive results for you! Learn more

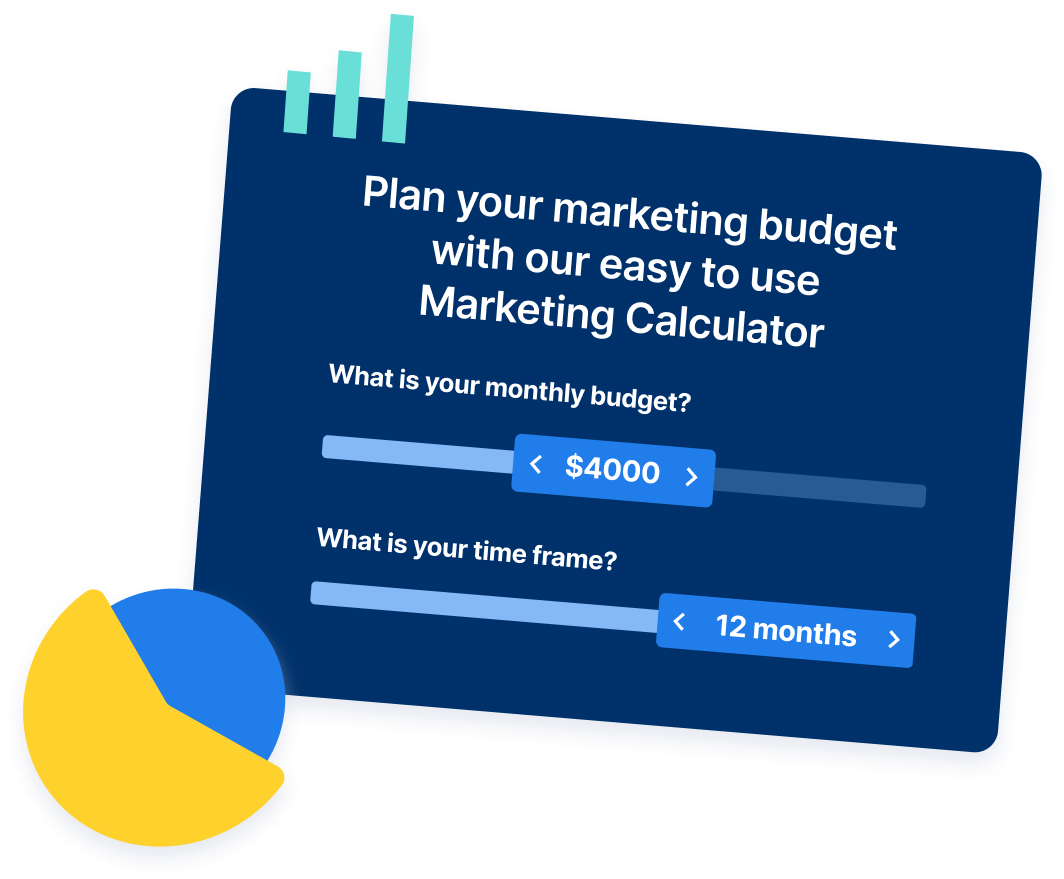

Try our free Marketing Calculator

Craft a tailored online marketing strategy! Utilize our free Internet marketing calculator for a custom plan based on your location, reach, timeframe, and budget.

Plan Your Marketing Budget

Table of Contents

- What are manufacturing marketing benchmarks (and why do they matter)?

- Key manufacturing marketing benchmarks you should track

- 💡 What these numbers mean for manufacturers

- 🎯 Spending too much for leads or clicks? Try these moves:

- 💡 How these metrics shape your funnel

- 💡 What this signals for your positioning

- 💡 What the data is really saying

- 💡 Where you win (or waste) budget

- FAQs about manufacturing marketing benchmarks

- Power your pipeline with benchmark-driven marketing

- Data sources & methodology

Get More Qualified Leads for Your Manufacturing Business

See how manufacturers like you are filling their pipelines with ready-to-buy leads through data-driven digital marketing.

Proven Marketing Strategies

Try our free Marketing Calculator

Craft a tailored online marketing strategy! Utilize our free Internet marketing calculator for a custom plan based on your location, reach, timeframe, and budget.

Plan Your Marketing Budget

What to read next