- Home

- Industries

- Heavy Equipment

- Heavy Equipment Marketing Benchmarks: Your 2025 Guide to Besting Industry Standards

Heavy Equipment Marketing Benchmarks: Your 2026 Guide to Besting Industry Standards

Quick look: Key heavy equipment marketing benchmarks

Here’s a quick look at average heavy equipment marketing benchmarks:

- Customer acquisition cost (CAC): $20,842

- Sales cycle: 180 days

- Touchpoints: 46

- Cost per lead (CPL): $396 per lead

- Conversion rate: 1.9%

- Cost per click (CPC): $5.01

Use these benchmarks to find out how your marketing efforts stack up against the industry standard and ensure you’re making the most of your marketing investments.

In an industry where efficiency drives profitability, heavy equipment companies understand the importance of optimizing their operations and efforts. Your pursuit of efficiency extends to other aspects of your business, including marketing.

Enter heavy equipment marketing benchmarks. They tell you how your campaigns stack up against industry standards and whether you’re maximizing your marketing return on investment (ROI).

Let’s look at key heavy equipment marketing benchmarks and valuable insights to ensure you’re not leaving money on the table:

- Customer acquisition benchmarks

- Lead generation costs: CPL benchmarks

- Sales cycle management

- Heavy equipment rental market intelligence

- Search opportunity benchmarks

Customer acquisition benchmarks

Leads aren’t cheap. Neither are new customers.

For heavy equipment companies, it takes $20,842 on average to acquire a new customer. This customer acquisition cost (CAC) benchmark reflects the industry’s long sales cycle and multi-touchpoint journey that clients take.

Let’s look at the other critical customer acquisition and sales cycle benchmarks that you must know to ensure that your marketing efforts are efficient and drive financial sustainability.

| Metrics | Benchmark |

| CAC | $20,842 |

| Required deal size | $69,473 (assuming 30% gross margin) |

| Sales cycle length | 180 days |

| Overall conversion rate | 1.9% |

| Referral rate | 4.98% |

The heavy equipment industry’s high CAC means companies must focus on large deal sizes and customer retention to sustain their growth. With a 1.9% conversion rate benchmark, companies must have a robust sales process that prioritizes qualified prospects who can potentially convert into satisfied customers.

Happy customers will likely renew their rental contracts, thus increasing your customer lifetime value (CLV). Satisfied customers will also likely refer the heavy equipment company to their network.

Heavy equipment companies get 4.98% of new clients through referrals. With an effective referral program, they can increase their referral rate and significantly reduce overall CAC.

Evaluate your CAC performance against the benchmark

A CAC that deviates from the benchmark doesn’t immediately mean that your marketing efforts are inefficient. Before you fumble for a fix for your CAC, examine the different factors that can affect your CAC:

| Factors affecting CAC performance | CAC is higher than the benchmark | CAC is lower than the benchmark |

| Market segment | Large industrial markets or premium custom heavy equipment markets | Smaller contractors or standard heavy equipment markets |

| Geographic market | Urban markets or competitive areas | Rural markets or areas with fewer competitors |

| Business model | Complex sales or single transactions | Focused on rental services or with repeat customers |

| Business maturity | New player (in the early stages of brand building) or expanding to new locations | Established companies |

| Sales cycle complexity | Complex sales cycle | Simple sales cycle |

| Average deal size | Large deals (likely higher than the required deal size benchmark of $69,473) | Small transactions (likely lower than the required deal size benchmark of $69,473) |

Heavy equipment companies typically operate with tight margins, so CAC concerns are understandable. You want to make the most of your marketing investment, ensuring every dollar drives valuable returns.

Note that CAC variations from industry standards may indicate legitimate business differences rather than marketing inefficiencies. That said, understand your specific business context first before making drastic changes to your strategies.

Ultimately, your CAC must align with your growth strategy, deal size, and business model.

What to do if your CAC is higher than the benchmark

A CAC that’s higher than the $20,842 industry average isn’t always a reason to panic. Heavy equipment businesses must know when it’s a red flag and when it’s normal and adjust their strategies accordingly.

| Higher than the CAC benchmark: Red flag or reasonable performance? | |

| Red flag | Reasonable performance |

| Your CAC exceeds your average deal size | You’re in the premium market segment with deal sizes of more than $100,000 |

| Your conversion rates are below the 1.9% industry average | You’re expanding to new locations |

| Your customer retention is low, despite spending more for acquisition | Your customer retention rates are high and your CLV to CAC ratio is 3:1 or better |

| Your sales cycle is significantly longer than the 180-day average | |

Here’s what you can do to identify your next steps:

Audit your CAC

Calculate your customer lifetime value (CLV) and deal sizes. If your CLV is high, it’s a good sign you’re retaining long-term customers, generating rental or service revenue for years, and justifying your acquisition cost.

Audit each marketing channel to find out which ones are increasing your average cost. Then, review your sales process to find out if you’re losing prospects at a particular stage.

Optimize your marketing and sales processes

Make the most of your acquisition costs with these tips:

- Run referral programs: Encourage your satisfied customers to refer your heavy equipment company. It can potentially reduce acquisition costs.

- Shift your budget to your highest ROI channels: Consider using your lower-cost channels. By industry standards, SEO and email nurturing are cost-effective ways to sustainably get new leads (below $250 CPL).

- Refine your ideal customer profiles (ICPs): When you refine your ICPs, you reduce the number of unqualified leads. Your sales team can then focus on profitable leads or prospects with a deal size of at least $69,473.

- Review your customer journey: Map out your customers’ 180-day sales cycle to identify bottlenecks and optimize conversions.

What to do if your CAC is lower than the benchmark

A CAC below the $20,842 benchmark appears to be a good thing on the surface, it may still require your attention because it could mean several things.

| Lower than the CAC benchmark: Untapped growth or optimal performance? | |

| Fix it if… | Leave it if… |

| Your profit hasn’t increased despite low acquisition costs | Your referral rates are higher than the 4.98% industry average |

| You lose bids to higher-priced competitors | Your conversion rates are higher than the 1.9% benchmark |

| Your sales team closes deals, but they’re low-value ones | Your average deal size results in healthy profit margins |

| Your market share is shrinking while your competitors grow | Your CLV to CAC ratio is 3:1 or better |

Identify opportunities

Lower CAC may indicate that you have untapped growth opportunities instead of optimal performance. Assess the following to find out if you’re missing out on revenue opportunities:

- CLV: Calculate your total revenue per customer, including sales, rental, service, and parts.

- Market opportunity: Find out if investing more in customer acquisition can result in additional market share or improved

- Pricing strategy: Find out if you’re underpricing — low pricing often attracts customers too easily. You might have room to optimize your pricing with a healthy acquisition cost.

Test more expensive, but higher-quality lead sources

Premium channels such as trade shows and LinkedIn ads have higher CPL, but they may deliver high-quality leads that you can nurture into long-term customers.

Test different channels incrementally, and track the following:

- CPL

- Cost per customer

- Deal size from each channel

Scale your market presence

If your CAC is below the benchmark, you have room to invest in growth before hitting unsustainable acquisition costs. Here are ways to do them:

- Increase your budget on best-performing channels: Double down on what’s working, but monitor results to ensure your increased budget is also resulting in increased revenue.

- Consider seasonal market expansion: Some heavy equipment companies can expand into markets with different seasonal patterns. You can target regions where peak season complements your current market’s off-season, so that your equipment doesn’t sit idly.

- Consider moving upmarket to premium segments: Expand to complex projects with higher equipment rates or bid for contracts with higher deal values.

Lead generation costs: CPL benchmarks

Qualified leads are the fuel that powers your sales engine. With a steady supply of high-quality leads, your sales process can keep generating revenue.

The question is: Are you overpaying for fuel? According to 2025’s industry reports, heavy equipment companies spend $686 per lead.

There’s room for optimizing your CPL

Looking at our proprietary data, though, you can further reduce your CPL:

| Metric | Benchmark |

| CPL industry standard | $686 per lead |

| Heavy equipment CPL benchmark (blended average based on proprietary and industry data) | $396 per lead |

If your CPL hovers around the $686 industry standard, you can optimize your lead generation efforts and potentially save $290 per lead.

B2B vs. B2C CPL data

Our proprietary data shows that B2B leads cost 53% less than B2C:

- B2B CPL benchmark: $205 per lead

- B2C CPL benchmark: $434 per lead

Heavy equipment companies serving both B2B and B2C customers can use these benchmarks when allocating budgets for their campaigns.

If your heavy equipment company primarily caters to B2C customers, you can still benchmark against the $434 CPL while exploring ways to reduce your lead acquisition cost.

Optimize your B2C CPL with these tips to boost profitability

Audit your current CPL

Identify your most expensive channels with significantly higher CPLs than the $434 benchmark. Then, find out why they’re expensive before pausing or cutting them out.

Here are some of the common factors contributing to a channel’s higher CPL:

- Audience targeting

- Competition

- Landing page or messaging mismatch

You can reallocate your budget to better-performing channels. Then, test and monitor your optimization efforts for underperforming channels.

Optimize your budget and campaigns during peak seasons

Understand your business’s seasonality. Allocate a higher budget for your campaigns during your peak seasons.

Make the most of your customers’ seasonal demands by targeting relevant searches, such as “fall cleanup equipment for rent.”

Prioritize high-quality leads with lead scoring

Lead scoring lets you quickly identify prospects who will likely rent or purchase from you. Nurture your most valuable leads first (so you don’t lose them to your competitors) before you tend to your cold leads.

Boost your local presence

Here are two quick wins you can do:

- Optimize your Google Business Profile

- Implement local SEO best practices

Then, instead of running lead generation campaigns for broad equipment searches, target local, long-tail keywords with purchase or rental intent. Here are sample keywords to target:

- [heavy equipment] rental near me

- same day [heavy equipment] rental

- weekend [heavy equipment] rental rates

- [heavy equipment] rental delivery

- Emergency [equipment] for rent near me

Consider these offline local efforts, too:

- Partner with home improvement shops

- Create referral (the heavy equipment industry has a 4.98% referral rate) and loyalty programs

- Participate in related community events with product demos

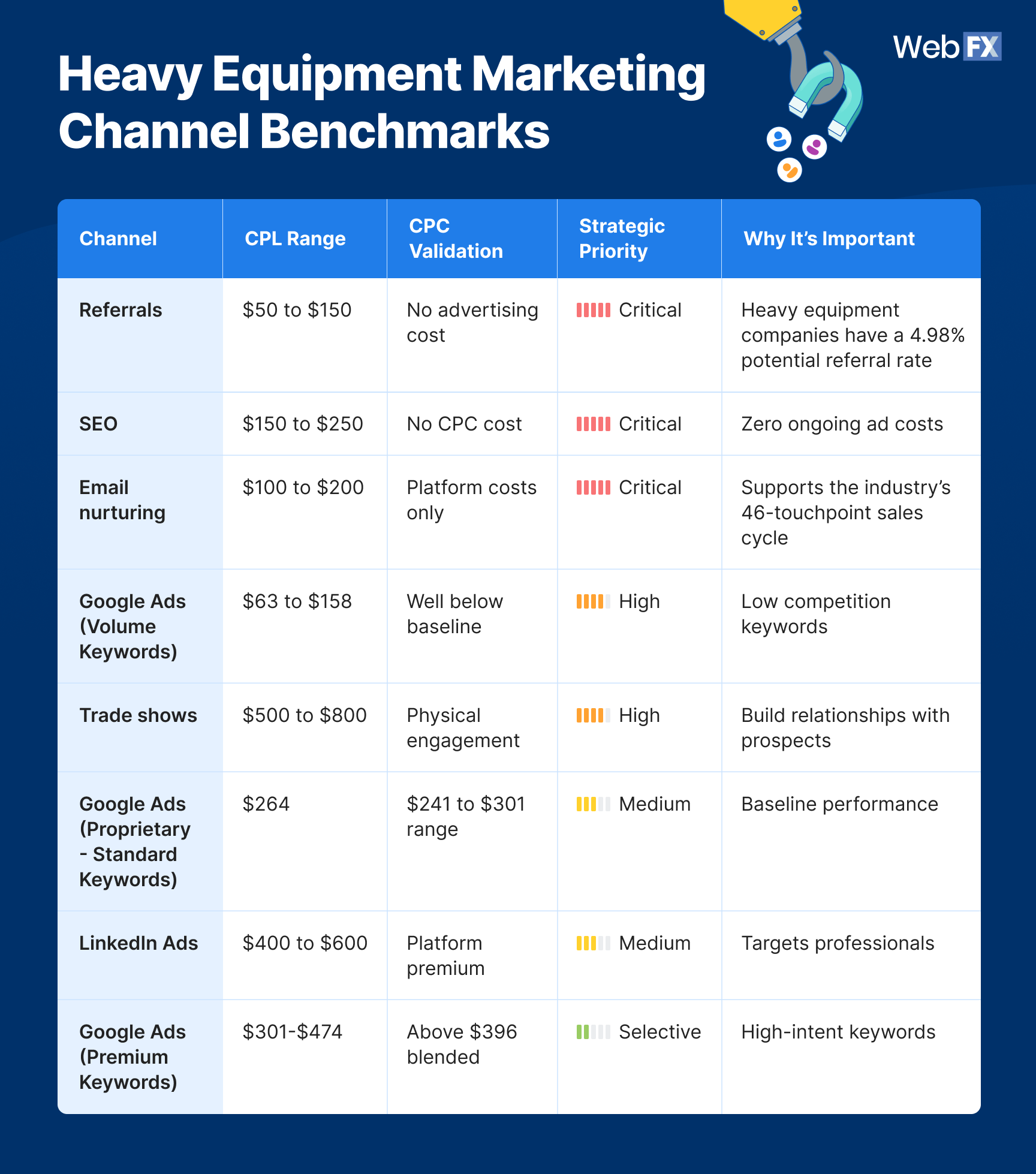

Prioritize referrals and SEO for $50 to $250 leads

Different channels deliver different CPL results. To find out which channels deliver the most cost-effective leads for heavy equipment companies, we analyzed each channel’s CPL with other factors such as the following to reflect real-world performance:

Our proprietary data on heavy equipment companies’ campaigns, including:

- 180-day average sales cycle length of heavy equipment companies

- Average of 46 touchpoints to acquire a new customer

- Average CPC of $5.01

- Conversion rate of 1.9%

- Heavy equipment industry standards

| Heavy Equipment Marketing Channel Benchmarks | ||||

| Channel | CPL Range | CPC Validation | Strategic Priority | Why It’s Important |

| Referrals | $50 to $150 | No advertising cost | Critical ⭐⭐⭐⭐⭐ | Heavy equipment companies have a 4.98% potential referral rate |

| SEO | $150 to $250 | No CPC cost | Critical ⭐⭐⭐⭐⭐ | Zero ongoing ad costs |

| Email nurturing | $100 to $200 | Platform costs only | Critical ⭐⭐⭐⭐⭐ | Supports the industry’s 46-touchpoint sales cycle |

| Google Ads (Volume Keywords) | $63 to $158 | Well below baseline | High ⭐⭐⭐⭐ | Low competition keywords |

| Trade shows | $500 to $800 | Physical engagement | High ⭐⭐⭐⭐ | Build relationships with prospects |

| Google Ads (Proprietary – Standard Keywords) | $264 | $241 to $301 range | Medium ⭐⭐⭐ | Baseline performance |

| LinkedIn Ads | $400 to $600 | Platform premium | Medium ⭐⭐⭐ | Targets professionals |

| Google Ads (Premium Keywords) | $301-$474 | Above $396 blended | Selective ⭐⭐ | High-intent keywords |

Based on our analysis, the top three critical channels that support the heavy equipment industry’s 180-day sales cycle are:

- Referrals

- SEO

- Email nurturing

These channels have CPLs that sit below $250 and our heavy equipment CPL benchmark of $396. Focus your efforts on these marketing channels, which drive long-term, organic growth, and continuously nurture your prospects until they’re ready to buy.

Closely monitor their results to see any changes in their monthly CPLs. Ensure you also implement referral tracking to measure its success.

Meanwhile, you can use premium channels (like LinkedIn Ads and Google Ads) for high-value prospects and high-intent keywords.

Sales cycle management benchmarks

Heavy equipment companies typically have long sales cycles. It then raises the question: What’s a normal sales cycle and what needs improvement?

Let’s look at the industry benchmarks that tell you where you can focus your optimization efforts:

| Metrics | Benchmark | What this means |

| Sales cycle | 180 days | A 6-month complex sales process |

| Touchpoints | 46 touchpoints | High-touch relationship building and nurturing |

| Lead-to-opportunity rate | 1.7% | Selective qualification process; opportunity definitions vary by company |

| Opportunity-to-close rate | 2.1% | Premium conversion quality; opportunity definitions vary by company |

| Overall conversion rate | 1.9% | Industry-standard performance |

Key areas to audit against sales cycle benchmarks

Use these benchmarks to identify which areas of your process need your attention. Compare your performance to each metric, and prioritize your next action items.

| Key areas | Benchmark | Action item |

| Pipeline planning | 180-day sales cycle | Plan sales forecasts six months ahead to align with actual sales cycle timing and cash flow planning. |

| Follow-up systems | 46 touchpoints | Implement systematic nurturing strategies with automation, structured follow-up communications, and well-planned content. |

| Lead quality | 1.7% lead-to-opportunity rate | This rate indicates how well you attract and nurture prospects.

|

| Sales process efficiency | 2.1% opportunity-to-close rate | This rate shows how qualified your prospects are and your team’s closing effectiveness.

If below: Audit your lead qualification process, sales training, and competitive positioning. If above: Assess whether you’re under-qualifying viable prospects. |

| Overall performance | 1.9% conversion rate | This rate reflects your complete marketing-to-sales process. Audit your funnel to identify where prospects are dropping off, then optimize your weakest conversion points first. |

Heavy equipment rental market intelligence

Equipment rental market benchmarks uncover the operational realities behind this industry’s marketing economics. These figures explain industry challenges around capital intensity, customer relationships, and competitive positioning that affect acquisition costs and long sales cycles.

Profitability insights

- Daily rental rates: $800/day for mid-size excavators + $1,500 mobilization fees

- Break-even requirements: 75 rental days annually for 30% ROI on $200,000 equipment cost

- Optimal equipment mix: Mini excavators (2 to 6 tons), skid steers (Cat 235/279), and compact loaders for highest utilization rates

Heavy equipment rental’s operational insights

- Capital requirements: $3 million is the recommended budget for sustainable heavy equipment rental operations.

- Regular maintenance: Annual maintenance is costly, with cylinder repairs reaching $88,000 for major damage.

- Equipment abuse: This is a universal concern among rental operators, because they must deal with equipment damage, which impacts profitability.

- Insurance costs: These costs are a major expense, with casualty insurance potentially eating up profits.

Strategic insights from equipment rental marketing benchmarks

Implement customer screening and qualification

High capital requirements ($3 million) and equipment damage risks make customer qualification critical. The high cost of maintenance and insurance can also eat up profits, so target experienced contractors and businesses to reduce operational risks.

Retain high-quality customers

Customers who don’t abuse equipment are valuable, long-term assets. Keep them happy, and they may even refer you to their network.

Build consistent demand throughout the year

With break-even utilization requiring 75 rental days per year, it’s important to keep a steady demand throughout the year. Here are some tactics:

- Off-season, helpful content

- Seasonal promos

- Customer retention programs

Promote after-sales capabilities as differentiators

When you bundle training, delivery, and maintenance support, you can justify your heavy equipment rental’s premium pricing over your competitors. That way, you also reduce the operational risks and keep your customers happy with your after-sales service.

Search opportunity benchmarks

Heavy equipment companies must maintain their visibility throughout six-month sales cycles. Organic search is a cost-effective way to sustain their presence among prospects. Let’s look at the challenges and opportunities.

Keyword opportunities

High-volume core equipment commercial keywords

| Core equipment search terms | Monthly volume | Average difficulty | Traffic potential | Search intent |

| Excavator | 108,000 | 26 | 24,000 | Commercial + Informational |

| Skid Steer | 95,000 | 42 | 5,300 | Commercial + Informational |

| Bulldozer | 43,000 | 20 | 4,500 | Commercial + Informational |

Top transactional keywords

| Transactional search terms | Monthly volume | Average difficulty | Traffic potential | Search intent |

| Excavator Rental | 10,000 | 16 | 28,000 | Transactional |

| Construction Equipment Rental | 1,900 | 78 | 79,000 | Commercial |

| Heavy Equipment for Sale | 1,500 | 45 | 1,000 | Transactional |

Top service and support keywords

| Service and support search terms | Monthly volume | Average difficulty | Traffic potential | Search intent |

| Crane Service | 1,200 | 26 | 60 | Commercial |

| Construction Equipment Financing | 900 | 12 | 1,900 | Commercial |

Search intent distribution

Commercial Intent: 65% (research, comparison, and evaluation)

Transactional Intent: 25% (ready to buy or rent)

Informational Intent: 10% (education, specifications)

Key search challenges and opportunities

Heavy equipment companies face various marketing hurdles that SEO can address. Here are common challenges and how a robust search strategy can help.

Challenges

Lead quality issues

Traditional marketing channels produce high-volume but low-converting leads.

Increasing online competition

Intense online competition is driving up digital advertising costs and CAC.

Buyer education

Heavy equipment companies must extensively educate their customers before they can make purchase decisions, prolonging the sales cycle.

After-sales support expectations

Customers evaluate heavy equipment companies based on their after-sales support, including maintenance, immediate parts availability, and customer service.

Suggested operation improvements

While SEO can address visibility and lead generation challenges, some of the business hurdles need operational improvements, such as:

Training and delivery services

Heavy equipment rental companies can add value by providing operator training and full-service delivery.

Attachment rental services

Offering heavy equipment attachment rental services is a high-margin opportunity. These attachments require minimal maintenance.

B2B focus

Focus operations and marketing on B2B clients and contractor associations instead of homeowners. B2B customers typically have longer-term needs, repeat business potential, and higher budgets.

SEO is a long-term, cost-effective strategy

The benchmark figures are clear: SEO provides a cost-effective and competitive opportunity for heavy equipment companies. Heavy equipment companies also report that organic search is their highest-quality lead source.

Let’s review the numbers quickly:

SEO has 60% lower CPL

While the industry’s CPL benchmark sits at $686 per lead, SEO’s CPL sits between $150 and $160.

This strategy gives you $436-$536 of savings per lead compared to industry averages. Plus, it also has zero ongoing advertising costs.

SEO offers low-competition opportunities

Our analysis shows that heavy equipment companies have opportunities to rank for core industry terms.

The top core equipment terms have difficulty scores between 20 to 42. Bulldozer (keyword difficulty of 20) and excavator (26) show lower competition, which means it’s easier to rank for them and get your prospects to find your business.

Meanwhile, search intent distribution shows that majority of searches (65%) have commercial intent, suggesting that most prospects research extensively before purchasing. Heavy equipment companies can implement an SEO strategy that:

- Captures these early-stage prospects

- Nurtures them with educational content

- Converts them when they’re ready to buy

SEO aligns with the industry’s six-month sales cycle

SEO is a long-term strategy that supports the heavy equipment industry’s long sales cycle (180 days). Publishing educational content fosters trust and addresses the customers’ knowledge gap.

Implement these SEO quick wins

- Target low-competition searches with commercial intent

- Target transactional, ready-to-buy searches with PPC

- Publish helpful educational content to nurture prospects and establish authority

- Optimize for location-based searches, which

- Publish relevant content for seasonal searches and project planning cycles

FAQs about heavy equipment marketing benchmarks

What are heavy equipment marketing benchmarks for 2026?

Here are critical benchmarks for heavy equipment marketing this year:

- Customer acquisition cost (CAC): $20,842

- Sales cycle: 180 days

- Touchpoints: 46

- Cost per lead (CPL): $396 per lead

- Conversion rate: 1.9%

- Cost per click (CPC): $5.01

How can I decrease my CAC without sacrificing lead quality?

Note that a CAC that’s higher than the heavy equipment marketing benchmark doesn’t necessarily mean you’re wasting your marketing dollars. Several factors affect your CAC, including the following:

- Market segment

- Business model and maturity

- Sales cycle complexity

- Average deal size

If you want to lower your CAC by attracting high-quality prospects, consider:

- Auditing your customer lifetime value (CLV) and deal sizes: Your CLV may be high because you’re retaining long-term customers, justifying the high cost of acquiring them. Find out which channels bring in the most high-quality leads.

- Running referral programs: Encourage your satisfied customers to refer your heavy equipment company to their network, which can potentially decrease your acquisition costs.

- Prioritizing larger deals: Nurture your valuable and larger deals.

- Mapping out your customer journey: Identify bottlenecks in your clients’ six-month sales cycle and optimize touchpoints to ease them into conversion.

What is the heavy equipment industry’s sales cycle benchmark?

The industry standard is 180 days (or about six months) with 46 touchpoints.

The long sales cycle reflects the complex B2B purchasing decision that involves multiple stakeholders. B2B buyers thoroughly research heavy equipment companies before they sign a rental contract or make a purchase. They also need to get their budgets approved before signing a deal.

Turn these benchmarks into your competitive advantage with WebFX

Increasing your heavy equipment company’s ROI involves calculated strategies that efficiently attract, nurture, and convert prospects. By benchmarking against these industry standards and auditing your processes, you ensure your customer acquisition efforts work like a well-oiled machine.

If you need an extended marketing team to help you, let the experts provide you with excellent service. WebFX is a full-service marketing agency with 100,000+ hours of experience in the heavy equipment industry.

Track, measure, and optimize your marketing efforts to maximize your returns when you partner with us. Our team of 145+ heavy equipment experts is pumped to do the heavy lifting of marketing your business.

Call us at 888-601-5359 or contact us online to gain your competitive advantage today.

Data sources and methodology

This report is based on multiple sources to reflect the accurate marketing performance benchmarks of the heavy equipment industry. It combines real-world marketing performance data from the industry, third-party data and insights, and our proprietary industry data:

- Proprietary data: Verified proprietary dataset, and internal industry benchmarks and performance metrics

- Third-party data: Ahrefs’ keyword intelligence report of 275,000+ monthly searches in the industry

- Community insights: 63 online discussions

- Analysis period: One year

- Geographic focus: United States market

- Report generated: July 31, 2025

We Drive Results for Heavy Equipment Companies

- 145+ experts in heavy equipment

- You get a team dedicated to your success

More Industry Resources

- 6 Ways to Use Digital Marketing for Equipment Rentals

- Digital Marketing Strategies for Heavy Equipment Companies

- Grow Your Revenue with These 6 Expert Strategies for Digital Marketing for Pavers

- Learn 5 Ways to Drive Revenue with Digital Marketing for Excavators

- Top 3 Digital Marketing Strategies for Forklift Dealers

- Heavy Equipment Trends

- 6 Best Heavy Equipment Marketing Agencies

We Drive Results for Heavy Equipment Companies

- 145+ experts in heavy equipment

- You get a team dedicated to your success

Table of Contents

- Customer acquisition benchmarks

- Lead generation costs: CPL benchmarks

- Sales cycle management benchmarks

- Heavy equipment rental market intelligence

- Search opportunity benchmarks

- FAQs about heavy equipment marketing benchmarks

- Turn these benchmarks into your competitive advantage with WebFX

- Data sources and methodology

Unmatched talent and tech for heavy equipment companies

$3,000

starting price for our services

25,963+

hours of heavy equipment marketing experience