- Home

- Industries

- Finance

- Wealth Management Social Media

Social Media for Wealth Management Companies [4 Tips]

Boost your wealth management company’s presence on social media through authenticity, regular content posting, audience engagement, and running targeted ads. Get help from WebFX’s expert team.

-

insights from 64,350+ hours of finance marketing experience

Did you know the average user spends 28% of their Internet time on social media?

Without a presence on social media, you’re missing a prime opportunity to reach your audience and engage with them to turn them into clients for your company. But how do you build a strong social presence that enables you to earn more clients?

If you want to do social media for wealth management companies right, follow these four tips:

- Be authentic to help people connect with your financial advisors

- Post content often to keep your brand top of mind

- Engage with your audience to build relationships

- Run social media ads to reach people who haven’t discovered your company yet

To learn more about these tips, keep reading! If you want to get help setting up a killer social media strategy from a team of 500+ skilled marketing experts, contact us online or call us today at 888-601-5359 to speak with a strategist about our social media services!

1. Be authentic to help people connect with your financial advisors

When you do social media marketing for financial advisors, you want to be authentic with your audience. Your audience doesn’t want to interact with a stiff, corporate drone on social media — they want to connect with the humanistic side of your company.

That’s why you must be authentic on whatever social media platforms you use to connect with your audience. It helps you make better connections with potential clients.

To be authentic on your social media profiles, you’ll want to think about your brand’s style. Some companies may take a humorous and lighthearted approach with their content, while others take a professional and educational approach.

Take some time to think about your brand’s unique style and how you want to convey that on social media. For example, if you’re a brand that takes a humorous and lighthearted approach, you may focus on creating fun polls about finances or using colorful graphics to engage your audience.

By being authentic to your brand, you help your audience know your company and build trust.

2. Post content often to keep your brand top of mind

A critical component of wealth management social media is posting content often. Your audience follows dozens of people on social media, including friends, family, and businesses. Their feeds are filled with posts from everyone they follow.

If you’re not posting content often, you’re going to fall through the cracks.

When you post content often, you increase the chances that potential clients see your content in their newsfeed. When they see your eye-catching content often, they’re more likely to engage with it and see more content in the future.

So, how often should you post content?

The truth is there’s no one good number of posts. The number of times you post in a day will vary depending upon your audience and the social network you use.

For example, it’s perfectly acceptable to post over a dozen times a day on a platform like Twitter. If you tried this same tactic on Facebook, though, you might have people complaining that you’re clogging up your feed.

So, if you want to do social media for wealth management companies right, you’ll need to do some experimenting with your audience. You can start by posting a couple of times a day and gradually adding more posts to the rotation until you find the right number.

When you’re posting all your content, use a social media content calendar. A social media content calendar makes it easy for you to plan when you’ll post and create content, so you can ensure your campaigns are cohesive. It also helps you identify content gaps you need to fill.

3. Engage with your audience to build relationships

One of the most significant benefits of social media for wealth management companies is that it enables you to build relationships with your audience. It’s one of the few marketing strategies that allow you to have a one-on-one connection with your audience.

The best way to nurture these relationships is to engage with your audience.

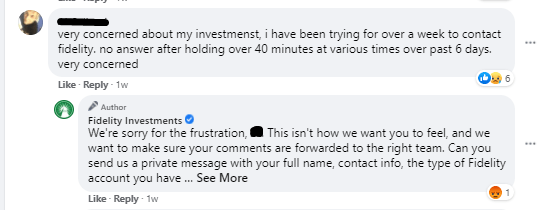

When you post content on your profile and your audience comments on it, take time to comment back to them. You’ll often find that many people will ask questions, make positive comments, or share a negative experience in the comments.

You can also engage with your audience through direct messages. On Facebook, for example, if someone messages your business, take time to respond to them. While you can use chatbots to answer simple questions, you can spend time answering more in-depth questions and building trust with your audience.

If you want to be effective with wealth management social media, you must spend time talking to your potential clients through comments and messages. It helps you show your audience that you’re listening, which can build their confidence in your company.

4. Run social media ads to reach people who haven’t discovered your company yet

When you do social media marketing for financial advisors, organic posting isn’t the only option for getting clients interested in your company.

There are hundreds of people looking for a financial advisor, and you can drive them to your company with social media ads.

Social media ads enable you to reach people who haven’t discovered your company yet. You can place your ads in users’ newsfeeds and help them discover your wealth management company.

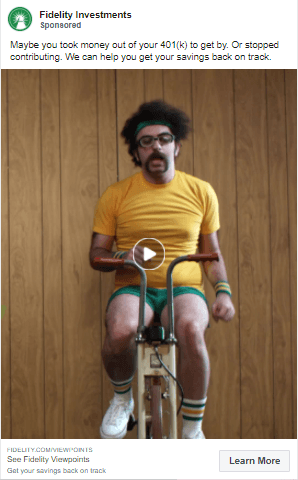

Each social media platform offers advertising services you can use to reach qualified leads. The types of ads you can run will vary depending upon the platform. When you know what platforms you want to use to reach your audience, you’ll need to check out the available advertisement options.

When you set up your ads, you’ll want to take advantage of the advanced targeting options available to your business. Social media platforms enable you to refine your targeting to tailor your ad content and message to specific members of your audience.

For example, you may have clients in their 30s and planning ahead for retirement and clients in their 60s about to retire and want to get their assets in order. These groups have different needs, and social media advertising makes it easy for you to deliver ad content that best fits various members of your audience.

To create compelling ad content for any of target audiences, you’ll want to ensure you have:

- Compelling visuals

- Convincing ad copy

- A relevant call to action (CTA) button

- Custom landing page

By adding social media ads as part of your wealth management social media plan, you’ll help your company reach more qualified leads and turn those leads into clients.

Get started with social media for wealth management companies now

Social media is a valuable tool that can help your business reach and connect with more people looking for a financial advisor.

This strategy isn’t a once and done project, though, and requires constant upkeep. When you’re busy trying to help your clients upkeep their portfolios, you may not have the time to dedicate to social media.

That’s where the experts at WebFX can help.

With over a decade of experience, we know how to craft social media campaigns that drive results. In the past five years alone, we’ve driven over $6 billion in sales and over 24 million leads for our clients.

Want to start driving more qualified clients for your business? Contact us online or call us today at 888-601-5359 to speak with a strategist about our social media marketing and social media advertising services!

Want to speak with an expert? Call us at 888-601-5359

We Drive Results for Wealth Management Companies

- Dedicated account manager backed by 500+ digital experts

- Renowned for our communication and transparency

Table of Contents

- 1. Be Authentic to Help People Connect with Your Financial Advisors

- 2. Post Content Often to Keep Your Brand Top of Mind

- 3. Engage with Your Audience to Build Relationships

- 4. Run Social Media Ads to Reach People Who Haven’t Discovered Your Company Yet

- Get Started with Social Media for Wealth Management Companies Now

We Drive Results for Wealth Management Companies

- Dedicated account manager backed by 500+ digital experts

- Renowned for our communication and transparency

Explore our finance case studies

Read our case studies for a more in-depth look at our results.

Solving key challenges for wealth management

Our website isn’t driving enough traffic

Boost your online visibility in search engines, increase your rankings, and drive more traffic to your website with a team of award-winning designers, SEO specialists, social media experts, and more.

We’re not attracting new customers

Encourage your prospects to sign up for your financial services with engaging website design and a seamless user experience that encourages your website visitors to become leads or clients.

We’re not selling the new services we offer

Need help promoting your financial services? Our range of revenue-driving digital advertising and marketing services helps you get your new services in front of your target audience on the channels where they spend their time.

We’re struggling to retain clients

Implement strategies and processes that build your brand loyalty and keep your current clients satisfied and coming back time and time again with our digital marketing solutions for client retention.