- Home

- Blog

- Digital Marketing

- The Essential Due Diligence Checklist for Private Equity Firms

The Essential Due Diligence Checklist for Private Equity Firms

-

Published: Dec 3, 2024

Published: Dec 3, 2024

-

9 min. read

9 min. read

-

Matthew Gibbons

Matthew Gibbons Senior Data & Tech Writer

Senior Data & Tech Writer

- Matthew is a marketing expert focusing on the SEO & martech spaces. He has written over 500 marketing guides and video scripts for the WebFX YouTube channel. When he’s not striving to put out some fresh blog posts and articles, he’s usually fueling his Tolkien obsession or working on miscellaneous creative projects.

Your firm has to perform due diligence whenever it makes a purchase, so you’re probably already well aware of what it is and why it’s important to get right. But you might not be as certain about what it should look like. Maybe you’re concerned that your due diligence process doesn’t include all the steps it should.

Don’t worry — on this page, we’ll walk through a due diligence checklist for private equity firms like yours. Keep reading to learn about each step of the checklist, or download it here:

Download Now: Private Equity Due Diligence Checklist

What is a due diligence checklist for private equity firms?

A private equity due diligence checklist is a list of specific company attributes you should investigate before making an investment. Any company you consider buying could potentially have issues you don’t know about, whether in its finances, its leadership, or something else altogether. If so, you want to catch those issues before you commit to a purchase.

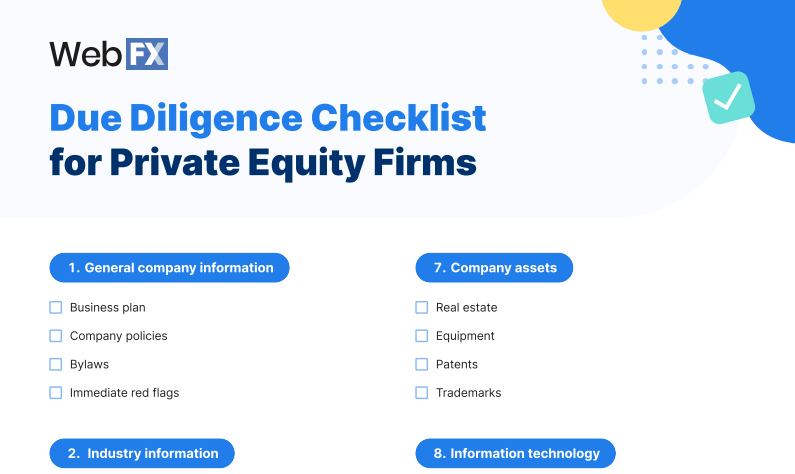

11-step private equity due diligence checklist

Now that we’ve explained what a private equity due diligence checklist is, let’s start talking about what’s on that checklist.

First, a quick caveat: Every private equity firm will have a slightly different list of items they need to look at, particularly depending on what type of company they’re looking at acquiring. That said, the items on this list are some of the most common things firms try to investigate.

Those items are:

- General company information

- Industry information

- Financial information

- Tax information

- Legal information

- Human resources

- Company assets

- Information technology

- Competitor outlook

- Existing clients and partners

- Leadership team members

- Marketing and advertising

Keep reading to find out about each one in more detail!

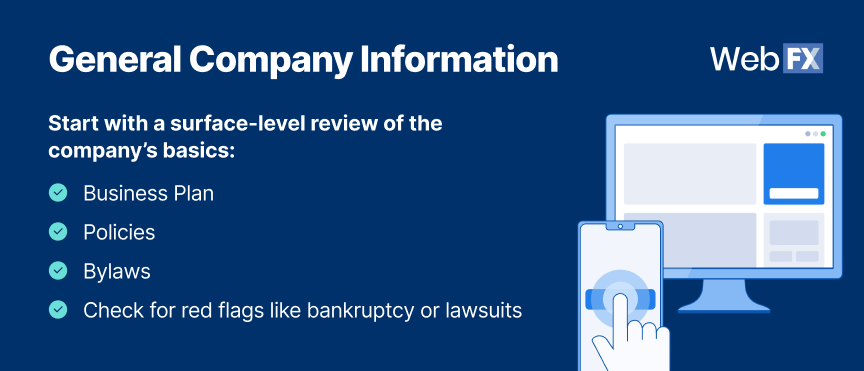

1. General company information

The first thing you’ll want to look into is general information about the company. That includes overall documentation like their company policies, business plan, corporate bylaws, and more. You should also do a surface-level sweep to make sure there are no glaring issues (like bankruptcy or huge lawsuits) that immediately jump out at you before you start the full due diligence process.

Points to check:

- Business plan

- Company policies

- Bylaws

- Immediate red flags

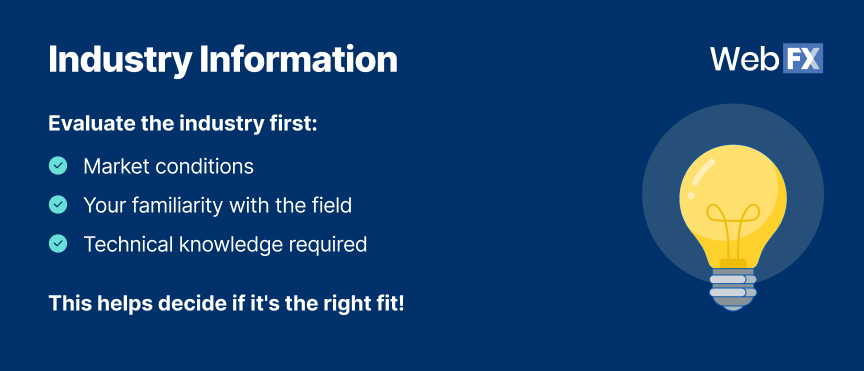

2. Industry information

The next area to cover is general industry information. Before zooming in on the details of the specific business, look at the industry it operates in. What’s the current state of the market? Is this an industry you’re at all familiar with? Do you feel confident operating a business in this field? The answers to those questions will help you decide whether to move forward.

Points to check:

- Current state of the market

- Familiarity with industry

- Level of technical knowledge needed

3. Financial information

One of the most important facets of any business to consider is its financial status. How much revenue is the company bringing in (and how much do you think it could be bringing in with better management)? How high are its expenses? All other areas of the company ultimately exist to serve this one, so make sure to give it the proper time and attention.

Points to check:

- Current revenue

- Current expenses

- Overall money management

4. Tax information

Related to financial information is tax information. Go through tax returns from the past few years and look into any audits that may have occurred. If the company has had issues making tax payments, or if it’s currently being audited by the IRS, those are obviously things you’ll want to know about.

Points to check:

- Tax returns

- Tax payment history

- Past or ongoing audits

5. Legal information

Another major part of the due diligence process involves looking into a company’s legal situation. Is the company in violation of any laws? Is it under investigation for anything? Is it currently involved in any legal disputes? If the answer to any of those questions is yes, that might give your firm cause to reconsider acquiring the business — but ultimately, it all depends on the details.

Points to check:

- Illegal activities

- Past or ongoing investigations

- Past or ongoing lawsuits

6. Human resources

Looking at human resources doesn’t just mean investigating the HR department at a company. It means looking at the whole organizational structure of the business to see what the hierarchy is, how many employees there are (and how they’re managed), and what the situation is in terms of things like salary and benefits. It’s also worth checking out the individual employees to see how qualified they all are.

Points to check:

- Business hierarchy

- Employee salaries

- Employee benefits

- Individual employee qualifications

7. Company assets

Next, you’ll want to check out all the assets belonging to the company you’re considering acquiring. That includes tangible assets like real estate and equipment, as well as intangible ones like intellectual property (patents, trademarks, etc.).

Points to check:

- Real estate

- Equipment

- Patents

- Trademarks

8. Information technology

Another area you should always include on your private equity checklist is information technology (IT). Basically, you want to be aware of all the computer hardware and software a company has. That includes any tech they’ve purchased, as well as any proprietary software they may have developed themselves. Make sure you pay attention to whether their tech is outdated.

Points to check:

- Computer hardware

- Computer software

- Proprietary company software

9. Competitor outlook

A big area to focus on is competition. If you were to buy this company and start improving its processes, what other businesses would you be up against? How much competition does it have, and how does it currently stand in relation to those competitors? Finally, do you see a viable way for this company to beat the competition under your direction?

Points to check:

- Number of major competitors

- Company standing relative to competitors

- Quality of competitor products or services

- Quality of competitor marketing

10. Existing clients and partners

It’s also crucial to understand who exactly a company sells to. Not only do you need to understand their ideal customer profile (ICP), but you should also familiarize yourself with any long-term clients they currently have. If you acquire the company, you’ll want to make sure you don’t lose those valuable clients in the process.

Points to check:

- Ideal customer profile (ICP)

- Existing long-term clients

- Buyer personas

11. Leadership team members

While an acquisition would mean your firm taking over a company, that would only be a temporary state of affairs. Long-term, the company’s success would depend on the leadership team within the company itself. That means you should take the time to investigate that leadership team and get a feel for how all of its members are performing in their roles.

Points to check:

- Individual company leader qualifications

- Leadership hierarchy

- Past leadership performance

12. Marketing and advertising

One of the biggest factors in a company’s success is its marketing. The way a company promotes itself to its audience, especially online, determines how much of that audience ends up buying its products or services. Take a look at the company’s current marketing and advertising campaigns to see how effective they are and how you might be able to better optimize them.

Points to check:

- Marketing budget

- Paid advertising performance

- Search engine optimization (SEO) performance

- Website design and quality

Upgrade your marketing due diligence process with WebFX

Using the private equity checklist outlined above, you can ensure that your due diligence covers all the most essential elements of a company before you make an investment. But one of the more challenging aspects of due diligence is that many of those elements might not be things you’re proficient in.

For example, if you’re not an expert in marketing, you may not be certain how effective a company’s current campaigns are or how you can optimize them. That’s why private equity firms often benefit from partnering with external agencies for help with those specialized subjects.

By partnering with a marketing agency like WebFX, you can get access to our marketing due diligence services. With those services, you can more easily pinpoint the strengths and weaknesses of a target company’s marketing efforts. That will help you develop a more thorough and accurate evaluation of the company.

Interested in partnering with WebFX? Just give us a call at 888-601-5359 or contact us online today!

-

Matthew is a marketing expert focusing on the SEO & martech spaces. He has written over 500 marketing guides and video scripts for the WebFX YouTube channel. When he’s not striving to put out some fresh blog posts and articles, he’s usually fueling his Tolkien obsession or working on miscellaneous creative projects.

Matthew is a marketing expert focusing on the SEO & martech spaces. He has written over 500 marketing guides and video scripts for the WebFX YouTube channel. When he’s not striving to put out some fresh blog posts and articles, he’s usually fueling his Tolkien obsession or working on miscellaneous creative projects. -

WebFX is a full-service marketing agency with 1,100+ client reviews and a 4.9-star rating on Clutch! Find out how our expert team and revenue-accelerating tech can drive results for you! Learn more

Try our free Marketing Calculator

Craft a tailored online marketing strategy! Utilize our free Internet marketing calculator for a custom plan based on your location, reach, timeframe, and budget.

Plan Your Marketing Budget

Table of Contents

- What is a due diligence checklist for private equity firms?

- 11-step private equity due diligence checklist

- 1. General company information

- 2. Industry information

- 3. Financial information

- 4. Tax information

- 5. Legal information

- 6. Human resources

- 7. Company assets

- 8. Information technology

- 9. Competitor outlook

- 10. Existing clients and partners

- 11. Leadership team members

- 12. Marketing and advertising

- Upgrade your marketing due diligence process with WebFX

Looking for More?

Get expert ideas, industry updates, case studies, and more straight to your inbox to help you level up and get ahead.

"*" indicates required fields

Proven Marketing Strategies

Try our free Marketing Calculator

Craft a tailored online marketing strategy! Utilize our free Internet marketing calculator for a custom plan based on your location, reach, timeframe, and budget.

Plan Your Marketing Budget

What to read next