- Home

- Industries

- Finance

- Banks

- 14 Banking Trends for 2026 & How To Implement Them

14 Banking Trends for 2026 & How To Implement Them

Keeping up with the latest trends in the banking industry is vital for staying ahead of your competitors. That’s why we’ll be looking at several such trends for 2026 below, including both general banking trends and marketing-specific ones. Read on for more info!

-

insights from 64,350+ hours of finance marketing experience

Table of Contents

- Banking industry trends

- 1. AI is boosting efficiency and security

- 2. Sustainability and ESG are growing concerns

- 3. Banking as a service (BaaS) is becoming more popular

- 4. Digital-only banks are on the rise

- 5. Consumer cash deposit accounts are becoming more emphasized

- 6. Traditional banks are using a family banking strategy

- 7. Invisible banking is becoming more widespread

- 8. Traditional banks are acquiring digital-only or fintech companies

- Banking marketing trends

- 1. Personalized banking experiences

- 2. Customer retention strategies

- 3. AI-powered marketing automation

- 4. “Waste out” to “value in”

- 5. Marketing to millennial parents

- 6. Transparency around fees and pricing

- Get ahead of banking industry trends with WebFX

- How is AI transforming banking operations in 2026? AI is improving customer service through chatbots and automated responses, enhancing risk management by evaluating market data, and strengthening fraud detection by analyzing customer patterns to identify suspicious transactions.

- What is Banking as a Service (BaaS) and why is it growing? BaaS allows non-banking businesses like Target and Chime to offer banking services by licensing with traditional banks, enabling these companies to provide financial options to customers while banks profit from new account relationships without direct interaction.

- Why are banks emphasizing consumer cash deposit accounts? Banks are offering high-interest yields on deposit accounts to attract high-value customers and increase cash on hand, which provides more flexibility to invest in loans, mortgages, and other interest-based financing during uncertain economic conditions.

- How should banks approach personalized marketing in 2026? Banks should identify primary audiences, connect with customers across multiple channels like phone, chatbots, and email, and offer accessible banking methods on both desktop and mobile to create tailored experiences based on customer data.

- What marketing strategy are traditional banks using to reach younger customers? Traditional banks are targeting millennial parents through digital advertising and family banking initiatives, encouraging these financially-savvy parents to teach their Generation Alpha children money management skills while introducing them to the bank’s brand for future customer retention.

2026 banking trends:

Banking trends in 2026 include a stronger focus on efficiency, innovation, and customer-centric experiences, driven by AI, invisible banking, and the rise of digital-only banks. To stay competitive, traditional banks are embracing strategies like BaaS, ESG initiatives, family banking, and fintech acquisitions to better align with changing consumer expectations.

The banking industry changes quickly with economic and consumer fluctuations. As these shifts occur, new trends emerge to help banks and consumers manage their finances and income. To understand and stay ahead in this industry, you must be up to date on banking trends — and on how those trends impact your marketing.

On this page, we’ve put together a list of industry and marketing trends to help you get ahead with your business strategy in 2026. Learn more about industry and marketing-specific banking trends below!

And, if you want to discuss digital marketing strategies for the banking or financial sector, call 888-601-5359 to chat with an expert!

Banking industry trends

We’ll start by looking at some of the biggest 2026 trends affecting the banking industry as a whole. Those trends include:

- AI is boosting efficiency and security

- Sustainability and ESG are growing concerns

- Banking as a service (BaaS) is becoming more popular

- Digital-only banks are on the rise

- Consumer cash deposit accounts are becoming more emphasized

- Traditional banks are using a family banking strategy

- Invisible banking is becoming more widespread

- Traditional banks are acquiring digital-only or fintech companies

Keep reading for more details about each of those trends.

1. AI is boosting efficiency and security

The state of the banking industry (as well as the world) is changing rapidly with AI. AI in banking will become more important for improving internal security processes, as well as customer-facing operations for banks.

Some example uses of AI in banking are:

- Customer service: Chatbots, automated responses, and personalized content all improve user experience (UX) while reducing manual workload.

- Risk management: AI programs can evaluate market and customer data to mitigate risky investments.

- Fraud detection: AI security programs can evaluate customer patterns and history to find fraudulent transactions.

These are just a few ways that banks are using AI in 2026. As AI progresses, companies will feel pressure to integrate these tools to keep up and offer the same benefits to their customers.

2. Sustainability and ESG are growing concerns

More and more industries are moving toward sustainable practices, all while taking environment, society, and governance (ESG) factors into account. The banking industry is no exception.

Some examples of ESG in banking include:

- Avoiding investments that could be harmful to the environment or local area

- Evaluating how banking processes affect climate change

- Prioritizing diversity, equity, and inclusion (DEI) in banking processes

The goal of ESG regulations in the banking industry is to pivot toward a more sustainable future.

3. Banking as a service (BaaS) is becoming more popular

BaaS is becoming more popular for financial companies. With BaaS, non-banking businesses can offer banking services by licensing with banks. That way, those businesses can benefit their customers with more options, and the banks make a profit from the customer account.

For example, Chime offers digital banking services with benefits like no-fee over-drafting and early access to payments.

However, Chime itself is not a bank. It’s a financial technology company that offers services through partner banks (Stride Bank and The Bancorp Bank).

Retail giant Target offers customers loans through credit cards. This allows banks to tap into a new customer base without direct interaction.

Starbucks, a coffee company, has even more money in its Rewards app, amounting to $1.9 billion in unspent rewards value (more than most US banks).

These examples show how BaaS is part of broader banking trends, with more services emerging to give customers flexible financing options.

4. Digital-only banks are on the rise

While brick-and-mortar banks aren’t going anywhere, 2026 sees a rising number of digital-only banks and banking services. These offer a customer-centric approach to banking that makes managing finances easy no matter where you are.

Some examples of digital-only banks include:

- SoFi

- Revolut

- Nubank

Now, as mentioned above, in-person banking isn’t going anywhere anytime soon. However, it is important to note that digital banks can reach and serve a wider audience, making them more competitive against larger, enterprise banks.

5. Consumer cash deposit accounts are becoming more emphasized

Slow growth after COVID-19, high costs, and inflation are all pointing toward a recession, which affects banks’ profitability. With that in mind, banks are looking for more cash deposit accounts to give them more flexibility and cash on hand.

Banks are giving high-interest yields on deposit accounts to encourage high-value customers to hold cash in the bank. This gives the banks access to more funds to expand and invest in loans, mortgages, and other interest-based finance.

This banking trend reflects the unstable state of the banking industry at the moment, as economic factors can cause future harm if not regulated or reversed.

6. Traditional banks are using a family banking strategy

Traditional banks are leaning toward having millennial parents pass their banking habits and preferences to their Generation Alpha children.

As millennials teach Gen Alpha better money management skills through family banking initiatives, traditional banks are banking (pun intended) on the next generation sticking to their parents’ preferred banks when they are in the market for a savings account or credit card.

7. Invisible banking is becoming more widespread

As traditional banks explore new ways of tapping underserved customer segments, it gives rise to invisible banking.

Through partnerships with other companies, whether retail or fintech startups, traditional banks will gladly step back from the transactions, letting other companies be the face while serving as the financier of the transaction. Through this frictionless process, consumers won’t even notice the bank that’s really behind the transaction.

8. Traditional banks are acquiring digital-only or fintech companies

Instead of building their digital capabilities from the ground up, traditional banks are opting to acquire existing digital-only or fintech companies. This helps traditional banks secure a younger demographic, adopt a quicker digital transformation, and access newer technologies.

Banking marketing trends

Now that we’ve covered the state of the banking industry as a whole, we can dive into some marketing-specific trends for banks. Here are some of the biggest ones:

- Personalized banking experiences

- Customer retention strategies

- AI-powered marketing automation

- “Waste out” to “value in”

- Marketing to millennial parents

- Transparency around fees and pricing

Get more detailed info about each of those trends below.

1. Personalized banking experiences

Personalization is the process of tailoring experiences, such as offers, content, recommendations and services, to a particular consumer. Personalization in the banking industry relies on customer data, usually first- or third-party.

With the challenging financial landscape, it’s more important than ever to reach clients on a personal level. Banks and other financial institutions know it, too — 86% of FIs stated that personalization is a clear, visible priority for the company and its digital strategy.

However, the path forward is not always clear. Here are some ideas for creating a personalized banking experience:

- Identify primary audiences from your website and client base

- Connect with customers across multiple channels (phone, chatbots, email, etc.)

- Offer multiple banking methods (desktop and mobile) and make them accessible

2. Customer retention strategies

Consumers are struggling with high prices, inflation, and other economic pressures that leave them hesitant toward spending. It’s more challenging and costly to bring new customers on, which goes against the ideals many banking leaders have.

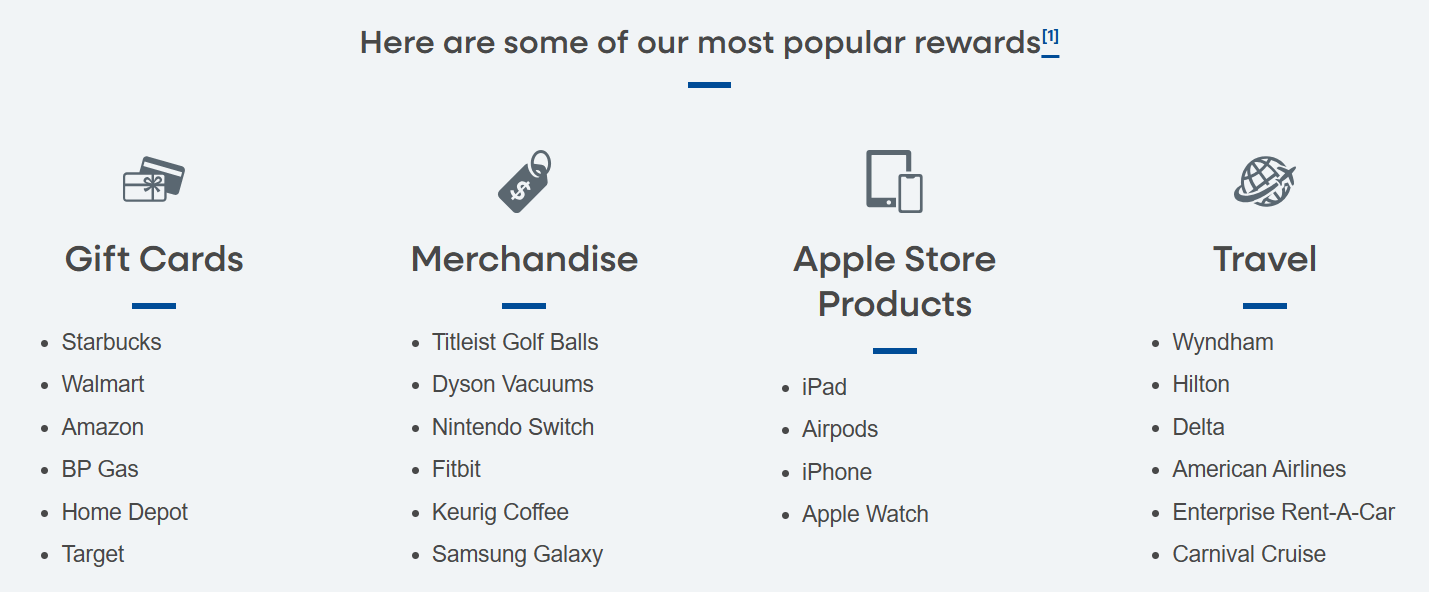

For that reason, banks should focus on customer loyalty and reward it to retain relationships (and income). PNC, for example, rewards customers with points when they sign up and spend on their Visa credit card:

They can then cash in those points for different rewards:

They also offer this service for businesses, which does a better job of including their entire market and encouraging signups for their services.

Depending on your institution, you might offer a similar program or find another way to reward loyal customers. And by promoting these benefits, you can also target new customers who might be looking for a better banking system.

3. AI-powered marketing automation

AI is becoming more and more important in the banking industry, reflecting one of the latest banking trends. However, it’s not just relevant to internal processes — you can also use it to make marketing easier for customer-facing tasks.

For example, marketing automation allows you to:

- Develop creative content and strategies to extend your marketing reach

- Sift through large amounts of customer data to look for patterns and trends

- Test different marketing tools, like pages or content

- Personalize communication with each customer

4. “Waste out” to “value in”

Another marketing trend to focus on is getting more from the waste your bank produces. The idea is to extract value from something that is considered waste.

For example, take AI. This tool can drive “waste out” by automating manual processes and freeing up time for your employees. It will also bring “value in” by allowing customer-facing employees to focus on important interactions with customers that drive more value inward.

5. Marketing to millennial parents

Millennial parents are financially savvy and huge savers, not spenders. Traditional banks are now resorting to digital advertising to reach these financially-savvy customer segment, helping these parents teach their kids about basic money management. Through millennial parents, traditional banks are indirectly introducing their brand to the next generation of customers.

6. Transparency around fees and pricing

In 2026, how clearly a bank explains its fees will matter just as much as the fees themselves. That’s because customers are getting sick of vague language and fine print leaving them unsure what to expect. They’re gravitating toward banks that explain fees in plain language and simple breakdowns.

At its core, this is very much a marketing issue. Many customers reject banks before even speaking with a representative, simply because they can’t find concise information on those banks’ websites related to the kind of fees they can expect. That means to set your bank ahead, you should go out of your way to be clear and transparent about any fees you charge.

Get ahead of banking industry trends with WebFX

The banking industry is unique and ever-changing. To help you get ahead of the curve, WebFX offers personalized digital marketing solutions aligned with your goals and industry trends.

With 64,350+ hours of experience in the finance industry, we know how to keep your plan fresh and competitive with changing industry trends. Our team of 164+ finance marketing experts can create custom, industry-focused marketing plans that earn you more revenue and influence in your market.

Want to see how we’ve helped clients in the past? View our case studies to see our data-backed results, and then contact us online to speak with a strategist!

Table of Contents

- Banking industry trends

- 1. AI is boosting efficiency and security

- 2. Sustainability and ESG are growing concerns

- 3. Banking as a service (BaaS) is becoming more popular

- 4. Digital-only banks are on the rise

- 5. Consumer cash deposit accounts are becoming more emphasized

- 6. Traditional banks are using a family banking strategy

- 7. Invisible banking is becoming more widespread

- 8. Traditional banks are acquiring digital-only or fintech companies

- Banking marketing trends

- 1. Personalized banking experiences

- 2. Customer retention strategies

- 3. AI-powered marketing automation

- 4. “Waste out” to “value in”

- 5. Marketing to millennial parents

- 6. Transparency around fees and pricing

- Get ahead of banking industry trends with WebFX

We Drive Results for Banks

- Dedicated account manager backed by 750+ digital experts

- Renowned for our communication and transparency

Explore our finance case studies

Read our case studies for a more in-depth look at our results.

Solving key challenges for banks

Our website isn’t driving enough traffic

Boost your online visibility in search engines, increase your rankings, and drive more traffic to your website with a team of award-winning designers, SEO specialists, social media experts, and more.

We’re not attracting new customers

Encourage your prospects to sign up for your financial services with engaging website design and a seamless user experience that encourages your website visitors to become leads or clients.

We’re not selling the new services we offer

Need help promoting your financial services? Our range of revenue-driving digital advertising and marketing services helps you get your new services in front of your target audience on the channels where they spend their time.

We’re struggling to retain clients

Implement strategies and processes that build your brand loyalty and keep your current clients satisfied and coming back time and time again with our digital marketing solutions for client retention.