-

7 min. read

7 min. read

-

Maria Carpena

Maria Carpena Emerging Trends & Research Writer

Emerging Trends & Research Writer

- Maria is an experienced marketing professional in both B2C and B2B spaces. She’s earned certifications in inbound marketing, content marketing, Google Analytics, and PR. Her favorite topics include digital marketing, social media, and AI. When she’s not immersed in digital marketing and writing, she’s running, swimming, biking, or playing with her dogs.

Customer churn definition: Customer churn is when someone from your customer pool stops buying your products, using your services, or renewing subscriptions from your business.

Customer churn, or customer attrition, is not the most exciting metric to measure and analyze. It is, however, one of the important revenue marketing metrics you should evaluate if you want to grow your business.

Think of it as a puzzle piece that will give you a better picture of your customer retention. Knowing your churn rate and understanding why your customers are turning away from your business is essential, so you can provide better services and products to keep your customers happy.

If you want to better understand what churn is, you’re on the right page!

Don’t miss our Marketing Manager Insider emails!

Join 200K smart marketers for the hottest marketing news and insights in your inbox.

Inline Subscription Form

“*” indicates required fields

What is customer churn?

Customer churn is when someone from your customer pool stops buying your products, using your services, or renewing subscriptions from your business. In other words, they stop being your customer.

What is the customer churn formula?

To measure this lagging indicator, calculate your churn rate using the formula:

Customer churn rate = Number of people who stopped being customers during a period / Number of customers at the beginning of the period

Calculate your churn rate by taking the number of people who stopped being customers during a certain period and dividing it by the number of customers you had at the beginning of that period.

For example, your software company has 1000 paid subscribers at the beginning of the month. By the end of the month, 140 of them downgraded to a free subscription or opted to uninstall your product. That gives you a churn rate of 14%.

You can check your churn rate monthly, quarterly or yearly, depending on the nature of your business. If you own a shop that sells Christmas trinkets, for example, it makes sense to measure churn every year instead of every month.

You can use the customer churn rate formula to calculate the following metrics for your business:

- Value of recurring business lost

- Percentage of recurring value lost

If you don’t want to calculate your churn rate using the formula, try our free Churn Rate Calculator to easily calculate your churn rate and your lost revenue. Input your total number of customers, the number of customers that churned, and the average worth of customers’ accounts to get your answer!

Why is customer churn important?

Achieving a 0% churn rate is challenging, and you’re probably wondering why you even have to measure and track this metric! Here are two reasons you’ll want to track your churn rate:

1. It comes with a cost

If your existing customers churn at a high rate, it will cost your business. In fact, it’s five times more costly to acquire new customers than to retain your current customers. That means you’ll work harder and spend more to get new customers to subscribe to your services or purchase your products.

2. It can affect your revenue growth

Did you know that a 5% increase in customer retention can double your business’s revenue? That’s because your most loyal customers will continue purchasing from you.

It is also reported that 77% of customers would recommend a business to a friend after a great experience. So, when your existing customers are churning, you reduce your chances to grow your revenue from your loyal customers and their referrals.

What are the causes of customer churn?

Customers leave for a variety of reasons, but they usually stop using your products or services because of:

1. Price

Competitors sprout and challenge your price. And when customers find a more cost-effective product or service they need, they churn.

2. Product fit

Product fit is a common reason for customers to churn. When a customer realizes that the product or service is not what they need, it’s natural for them to not re-purchase or renew a subscription.

3. User experience

When a customer experiences friction with your product or service, they may search for a replacement online or via referral by friends. Customers have a lot of options, so they’ll churn when they’re not satisfied with a product or service.

4. Customer experience

Consumers have high expectations from the brand they purchase from. When deciding what to buy, 83% of consumers say good customer service is the most important factor (besides price and product). When their expectations are not met, chances are, they’ll churn and switch to a brand offering a better customer experience.

How do you reduce customer churn?

It’s worth noting that some churn may be natural — and even good — for your business. For example, pretend you’re offering a free app. As your app’s features expand and your company grows, you start offering it as a paid app. Your existing customers may churn, but new customers who are willing to pay for a feature-packed app will sign up.

Overall, it’s best to reduce the chances of your customers churning during their customer lifecycle.

Here are some tips to help you reduce your churn rate:

- Pay attention to your best customers

- Make churn analysis an ongoing practice

- Take care of your customers

- Stay relevant and competitive

1. Pay attention to your best customers

Nurturing your customers shouldn’t end the moment they check out. Providing excellent customer service after these prospects convert will help you maintain loyal, repeat customers.

Stay in touch with these customers. Find out if they have new and unmet needs from your products or services. Give them rewards in the form of exclusive offers or freebies to keep them from churning.

2. Make churn analysis an ongoing practice

Use the power of data on both satisfied and unhappy customers to predict when customers are on the brink of churning. Your analysis of your customers will help you create strategies to prevent them from leaving your business.

For example, let’s say you offer home cleaning services. Are your loyal customers using your services less frequently than before? When do customers usually churn? Is it after a certain number of services availed, or after a certain period?

3. Take care of your customers

Proactively communicate with your customers before they reach out to you for any questions or clarifications. Send them reminders about your product features that they’re not maximizing. Tell them about the latest offers that benefit them.

Let them know that their feedback matters. Did you know that 50% of customers naturally churn every five years? Of these customers, only 1 of 26 dissatisfied customers complains, while the rest leave. Encourage feedback from your customers, so you can address what’s making them unhappy.

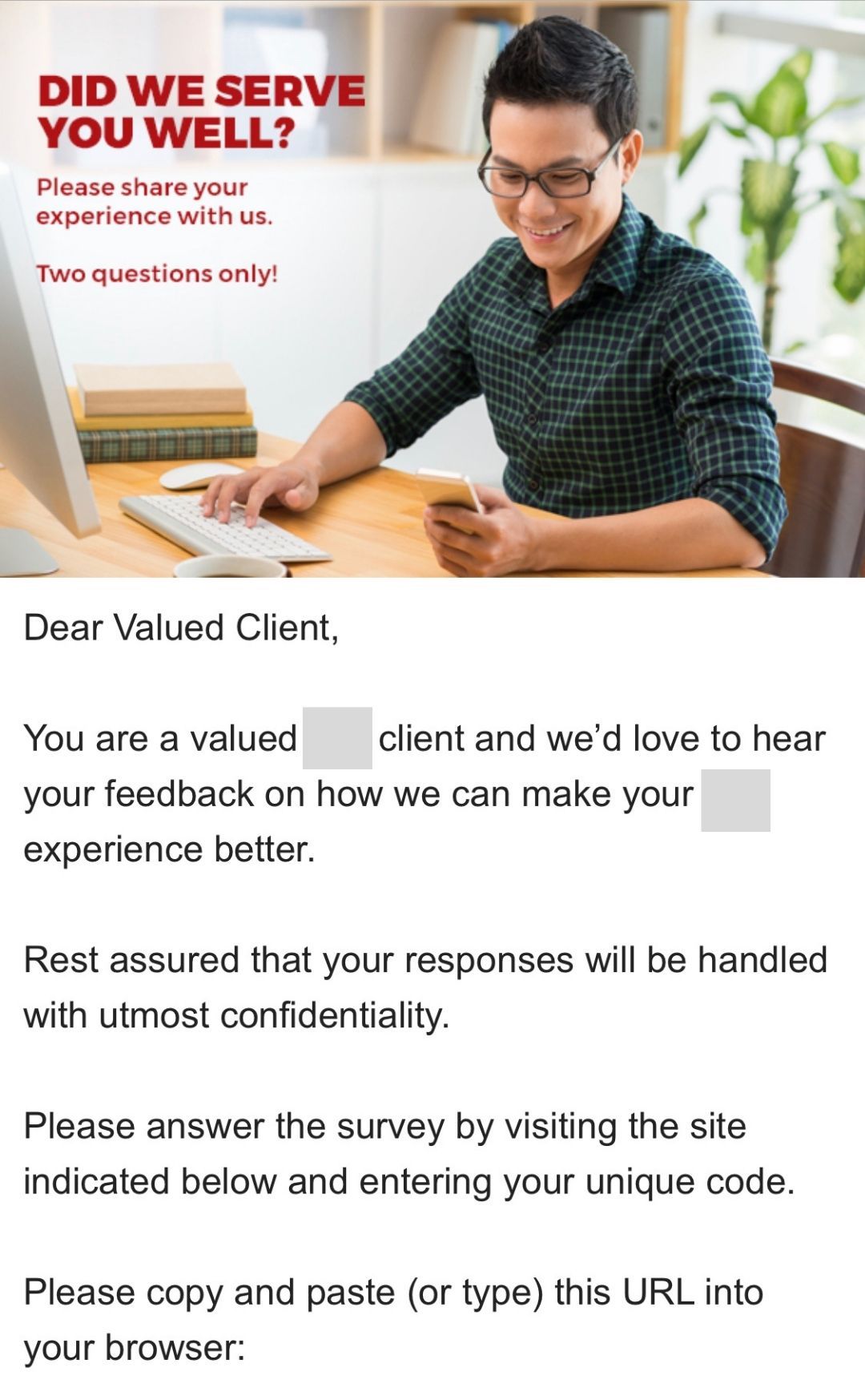

For example, a bank can email its client asking about how their last online transaction went. Tell them that their feedback matters, and provide a link to a survey form. Lastly, assure them that their answers will be handled with confidentiality.

4. Stay relevant and competitive

Customers’ needs evolve. Your product may be addressing their needs today, but is your product future-proof? Regularly check in with your customer about the product and service they use and get feedback on how you can improve to better serve them.

If you were a home cleaning business, you could regularly send customers Net Promoter Score (NPS) surveys every year or every six months. You could also send a post-service feedback survey to know what your customers liked about the service or process, and what they think needs improvement.

It’s also important to monitor your competitors. What are the new features they’re offering? What are the questions they’re asking their existing customers to further improve their product or services?

Meet WebFX:

Your world-class, tech-enabled marketing agency with over 1.6 million hours of combined expertise.

Are you up to conducting a customer churn analysis?

If you haven’t been measuring your churn rate, now is a good time to start. Our free Churn Rate Calculator helps you easily calculate your churn rate.

Not sure where to begin? Contact us online or call us at 888-601-5359 to speak with a strategist. Our team of 500+ experts is excited to help you reduce your churn, retain more customers, and grow your business’s revenue!

-

Maria is an experienced marketing professional in both B2C and B2B spaces. She’s earned certifications in inbound marketing, content marketing, Google Analytics, and PR. Her favorite topics include digital marketing, social media, and AI. When she’s not immersed in digital marketing and writing, she’s running, swimming, biking, or playing with her dogs.

Maria is an experienced marketing professional in both B2C and B2B spaces. She’s earned certifications in inbound marketing, content marketing, Google Analytics, and PR. Her favorite topics include digital marketing, social media, and AI. When she’s not immersed in digital marketing and writing, she’s running, swimming, biking, or playing with her dogs. -

WebFX is a full-service marketing agency with 1,100+ client reviews and a 4.9-star rating on Clutch! Find out how our expert team and revenue-accelerating tech can drive results for you! Learn more

Try our free Marketing Calculator

Craft a tailored online marketing strategy! Utilize our free Internet marketing calculator for a custom plan based on your location, reach, timeframe, and budget.

Plan Your Marketing Budget

Proven Marketing Strategies

Proven Marketing Strategies

Try our free Marketing Calculator

Craft a tailored online marketing strategy! Utilize our free Internet marketing calculator for a custom plan based on your location, reach, timeframe, and budget.

Plan Your Marketing Budget