-

Published: Dec 27, 2023

Published: Dec 27, 2023

-

5 min. read

5 min. read

-

Maria Carpena

Maria Carpena Emerging Trends & Research Writer

Emerging Trends & Research Writer

- Maria is an experienced marketing professional in both B2C and B2B spaces. She’s earned certifications in inbound marketing, content marketing, Google Analytics, and PR. Her favorite topics include digital marketing, social media, and AI. When she’s not immersed in digital marketing and writing, she’s running, swimming, biking, or playing with her dogs.

Leading vs. lagging indicators

Leading indicators are data that help forecast future performance, while lagging indicators are data that analyze past performance, trends, and patterns.

Leading and lagging indicators are critical, time-based metrics for forecasting business performance and analyzing past trends. Both are essential to understanding economic trends and predicting future events.

Keep reading to better understand the differences between leading and lagging indicators as we go through these topics:

- What are indicators?

- Leading vs. lagging indicators for businesses: The differences

- Examples of leading indicators

- How to use leading indicators

- Examples of lagging indicators

- How to use lagging indicators

Feel free to jump to any topic. Then, join our community of marketers by signing up for our newsletter and get your dose of the latest digital marketing tips for free!

Don’t miss our Marketing Manager Insider emails!

Join 200,000 smart marketers and get the month’s hottest marketing news and insights delivered straight to your inbox!

Enter your email below:

Inline Subscription Form – CTA 72

“*” indicates required fields

(Don’t worry, we’ll never share your information!)

What are indicators?

Definition of indicators in business

Indicators are pieces of data that measure business or economic conditions and predict future trends.

Indicators are essential for organizations because they help measure your strategies’ effectiveness and improve them.

Think of indicators like your car’s dashboard, which tells you your speed, fuel level, outside temperature, and other critical stats that alert you to any potential issues. Leading and lagging indicators are two types of indicators for businesses.

Leading vs. lagging indicators for businesses: The differences

Now that you know what indicators are, let’s look at the differences between leading and lagging indicators for businesses. The table below summarizes their differences:

| Leading indicators | Lagging indicators | |

| Definition | Leading indicators are pieces of data that provide insights into future performance. | Lagging indicators are pieces of data that analyze past performance and events. |

| Examples | – New market growth – Sales pipeline – Customer satisfaction |

– Annual revenue – Sales cycle length – Customer churn rate |

| Uses | – Forecasting economic and market trends – Strategic planning – Risk management |

– Evaluating business performance – Comparing your performance vs. industry benchmarks or competitors – Identifying and confirming new trends |

Let’s dive into each one:

What is a leading indicator?

Leading indicator definition

A leading indicator is data that provides insights into future performance.

Leading indicators can help you predict your business’s future performance and economic trends. These data points provide forward-looking insights and inform your strategies.

While a leading indicator is a critical part of performance monitoring, it may not always show the whole picture. You can’t create accurate predictions by looking only at individual leading indicators.

For example, customer satisfaction is a leading indicator that tells you how likely customers are to repurchase and recommend your business. A high customer satisfaction rate may inform you that your revenue will likely remain the same or increase.

However, you must also consider economic conditions and even lagging indicators (which we’ll discuss later) for a well-balanced prediction. Economic conditions may influence your customers’ purchasing habits — for instance, consumers may spend less during a recession.

What are examples of leading indicators?

Examples of leading indicators are:

- New market growth: This leading indicator tells you potential expansion in new markets and higher revenue in the future.

- Sales pipeline: The sales pipeline is a leading indicator of potential sales opportunities. It also shows you the health of your sales process and predicts whether you can expect increased sales in the future.

- Customer satisfaction: This leading indicator tells you how happy your customers are with your products or services. Satisfied customers will likely repurchase from you or refer you to someone else. That said, customer satisfaction is one of the indicators you can track to predict your revenue in the future.

- Global and local economic health: The economy is a leading indicator that tells you the overall well-being of the economy, which can affect your business.

How to use leading indicators

Leading indicators provide you with predictive insights. Use them for the following:

- Forecasting economic and market trends: Leading indicators give you valuable insights that enable you to forecast changes in the economy and markets you’re in. As a result, you can plan and adapt to these changes.

- Strategic planning: By providing you with predictive insights, leading indicators enable you to set realistic goals and strategize accordingly.

- Risk management: Leading indicators help businesses identify and assess threats or risks regarding capital, revenue, security, and other factors affecting business operations.

What is a lagging indicator?

Lagging indicator definition

A lagging indicator is data that analyzes past performance and events to measure success.

Lagging indicators offer insights that show your business’s historical performance and growth. That said, these indicators are a measurement of one’s performance over time.

An important aspect of your performance management, lagging indicators show you the truth about your results. Unlike leading indicators, which give you insights about what may happen, lagging indicators are final.

An example of a lagging indicator is revenue. You can’t change the revenue you’ve earned for a particular period.

What are examples of lagging indicators?

Here are some examples of lagging indicators:

- Annual revenue: Annual revenue is a lagging indicator that tells you the total revenue that your business generated in a given year.

- Average sales cycle length: This lagging indicator tells you the average time it takes for a prospect to become a customer. It reveals your sales process’s efficiency.

- Customer churn rate: This lagging indicator tells you the percentage of customers who stopped purchasing your products and services.

How to use lagging indicators

Lagging indicators give insights into your business’s historical performance and market conditions. You can use lagging indicators to:

- Evaluate your business’s historical performance

- Compare your performance against industry benchmarks or competitors

- Identify and confirm new trends

We’re masters of our craft.

WebFX is a marketing and design industry leader.

Meta, Amazon, and Google Partner

books read

blog posts written

industries worked in

Google Certified team members

CMS experts

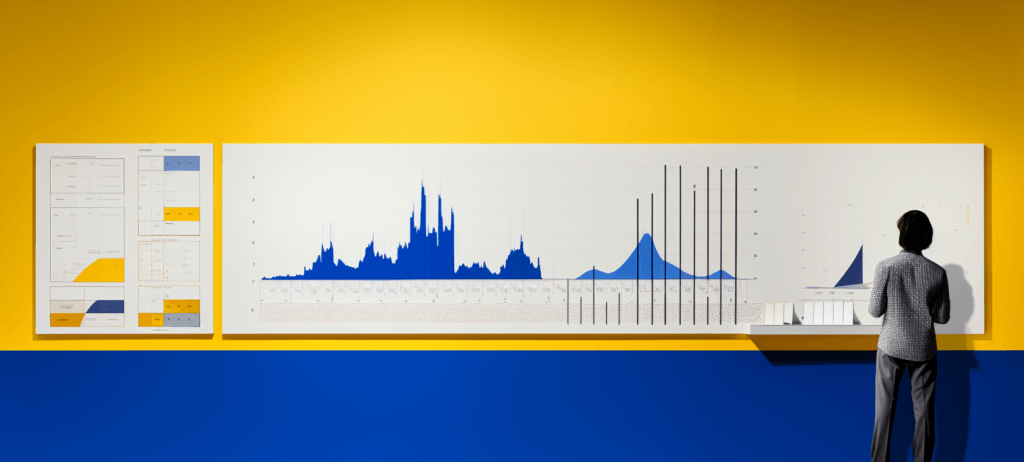

Understanding leading vs. lagging indicators for businesses

Leading and lagging indicators are both important to see the whole picture of how your business is performing and how it can potentially grow in the future.

If you’re ready to grow your business with effective digital marketing strategies, consider teaming up with WebFX. We’re a full-service digital marketing agency with over 28 years of experience driving leads and generating over $6 billion in revenue for our clients.

Our IBM Watson artificial intelligence-powered (AI-powered) growth platform, MarketingCloudFX, can house all your data so you can quickly analyze your performance and forecast future trends that you must act on.

Call us at 888-601-5359 or contact us online to speak with a strategist about our digital marketing services!

-

Maria is an experienced marketing professional in both B2C and B2B spaces. She’s earned certifications in inbound marketing, content marketing, Google Analytics, and PR. Her favorite topics include digital marketing, social media, and AI. When she’s not immersed in digital marketing and writing, she’s running, swimming, biking, or playing with her dogs.

Maria is an experienced marketing professional in both B2C and B2B spaces. She’s earned certifications in inbound marketing, content marketing, Google Analytics, and PR. Her favorite topics include digital marketing, social media, and AI. When she’s not immersed in digital marketing and writing, she’s running, swimming, biking, or playing with her dogs. -

WebFX is a full-service marketing agency with 1,100+ client reviews and a 4.9-star rating on Clutch! Find out how our expert team and revenue-accelerating tech can drive results for you! Learn more

Try our free Marketing Calculator

Craft a tailored online marketing strategy! Utilize our free Internet marketing calculator for a custom plan based on your location, reach, timeframe, and budget.

Plan Your Marketing Budget

Table of Contents

- What Are Indicators?

- Leading vs. Lagging Indicators for Businesses: the Differences

- What is a Leading Indicator?

- Examples of Leading Indicators

- How to Use Leading Indicators

- What is a Lagging Indicator?

- Examples of Lagging Indicators

- How to Use Lagging Indicators

- Understanding Leading vs. Lagging Indicators for Businesses

Maximize Your Marketing ROI

Claim your free eBook packed with proven strategies to boost your marketing efforts.

Get the GuideTry our free Marketing Calculator

Craft a tailored online marketing strategy! Utilize our free Internet marketing calculator for a custom plan based on your location, reach, timeframe, and budget.

Plan Your Marketing Budget