- Home

- Industries

- Finance

- marketing budget for financial services

Marketing Budget for Financial Services: Plan Your 2025 Marketing Spend

For companies that work in the financial industry, budgeting is second nature. When it comes to your marketing, however, it might not be as easy. Creating a marketing budget for financial services is essential for ensuring proper business growth.

-

insights from 64,350+ hours of finance marketing experience

How much do financial services companies spend on marketing?

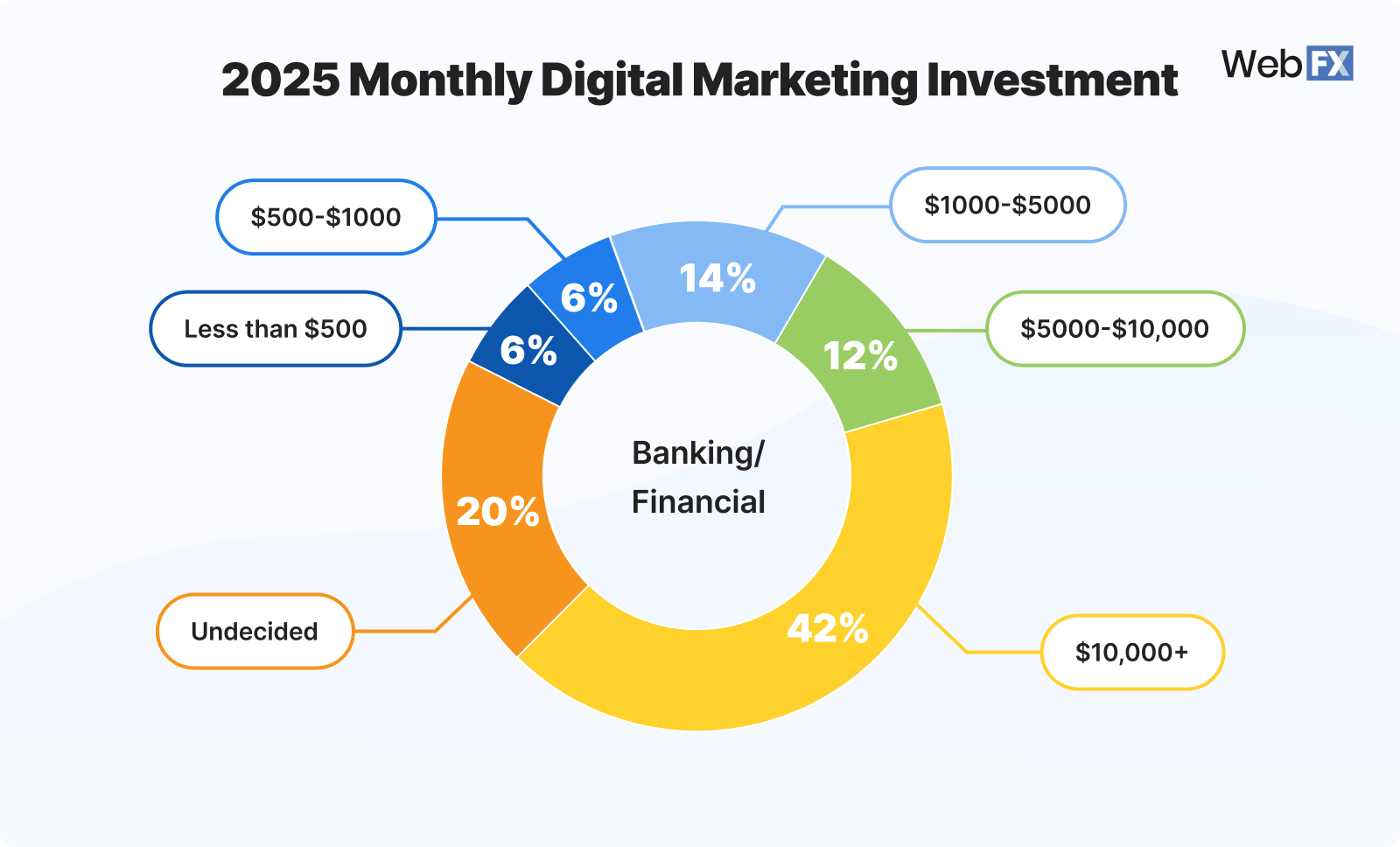

Financial companies spend between $5,000 and $10,000+ a month on digital marketing, on average.

We will break down how to plan a marketing budget for financial services through the following sections:

- How much do financial services companies spend on marketing?

- Financial services marketing budget breakdown

- Factors that impact financial services marketing budgets

- How to create a financial services marketing budget

- FAQs on financial services marketing budgets

Read on to learn more! And check out our downloadable budget planner to help you get started!

Download Now: Free Finance Marketing Budget Template

How much do financial services companies spend on marketing?

Financial companies between $5,000 and $10,000+ a month on digital marketing on digital marketing, on average. In terms of percentages, the industry standard is 7-10% of revenue spent on marketing.

Here’s a better look at those figures:

Financial services marketing budget breakdown

So, what does that $10,000 a month include? That depends on your company’s revenue, marketing provider, and marketing channels. Here is a financial services breakdown of digital marketing costs, based on the most popular services in your industry:

|

2025 Financial Services Marketing Spend |

|

| Channel | Monthly Spend |

| Paid Advertising *Includes Google Ads, LinkedIn Ads, programmatic ads, etc. |

$100-$10,000 |

| Search Engine Optimization (SEO) *Includes local SEO, technical SEO, and mobile integration for apps |

$2,500-$7,500 |

| Social Media | $100-$5,000 |

| Email Marketing & SMS | $50-$100 |

| Content Marketing *Includes long-form content and sales copy |

$5,000-$10,000 |

| Brand Positioning & Reputation Management *Includes PR, review management, customer support, etc. |

$5,000-$10,000 |

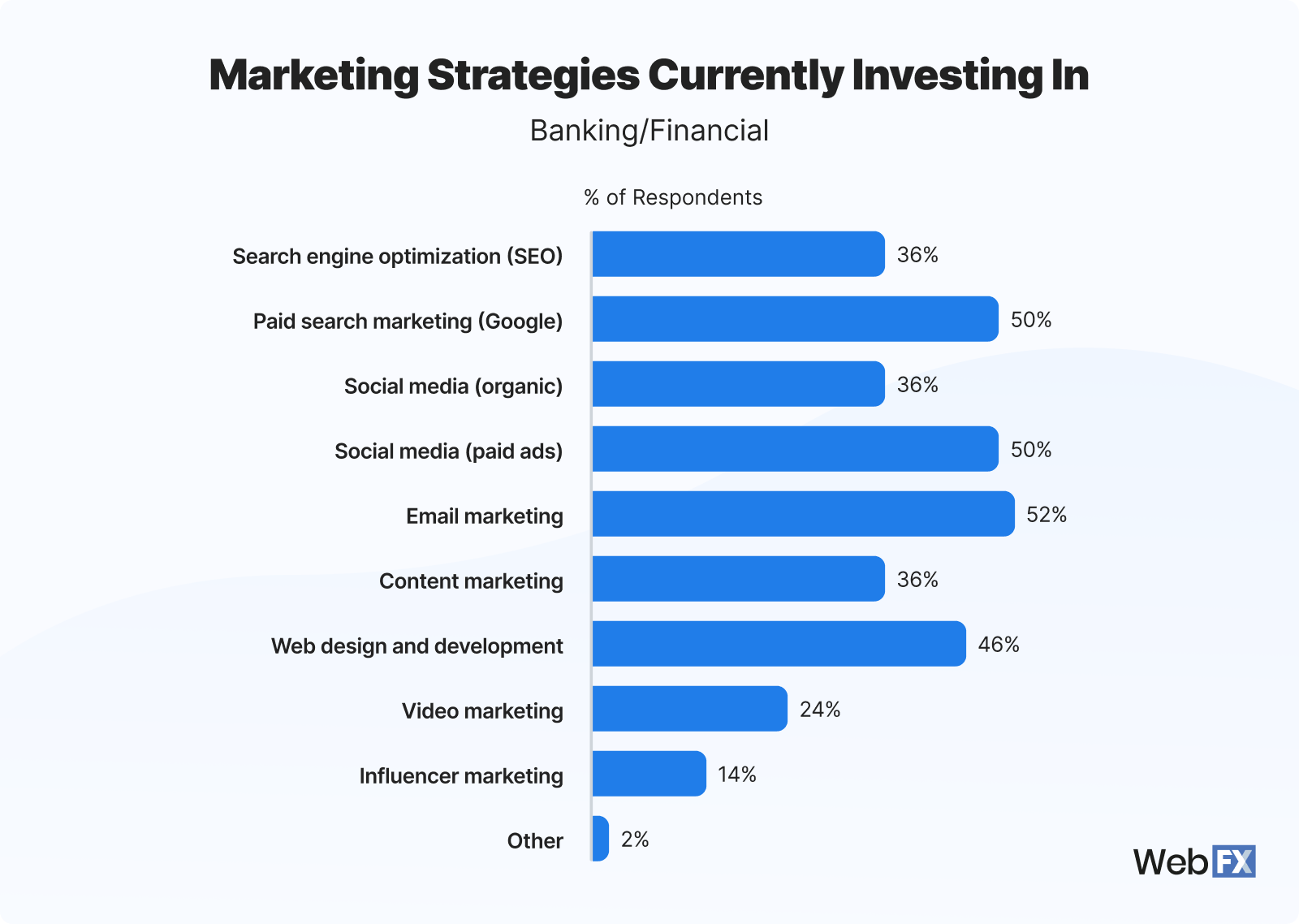

Here’s a more complete look at what financial companies are investing in:

PE Firms

PE firms’ marketing budgets should focus on marketing the firms they invest in. This niche might spend more on marketing than other financial companies, depending on your investment portfolio.

The top services for PE firms relate to brand management and positioning. SEO and digital advertising increase visibility, helping you reach industry executives and high-net-worth individuals. Your investor communications will foster trust and encourage future commitments and contracts.

Data-driven strategies and LinkedIn marketing enable better targeting and measurable ROI, while event sponsorships and reputation management encourage relationships and credibility. Together, these services position PE firms as leaders in their space, encouraging future investments and revenue.

Banks

Digital marketing for the banking industry includes SEO, PPC, email marketing, and content marketing, all of which help educate the end consumer on your offerings. These digital marketing methods educate customers on financial topics and promote products like loans, credit cards, and savings accounts.

Another key area in banking marketing budgets is data security. You handle individual’s and businesses’ private information, so you need to prove that they can trust you.

Some marketing tactics you might invest in include secure web design and development. These services are priced as follows:

- Web design: $501 – $5000 per year

- Web development: $1001 – $10,000 per year

By leveraging data and digital tools, banks can engage existing customers and stay competitive in a digital-first financial landscape.

General financial services/ financial advisers

The marketing budget for general financial services or financial advisers should include any combination of the services outlined above. Since the ultimate goal for many financial companies is earning trust and closing financial deals, SEO, PPC, email marketing, and web design are the top services to start with.

Factors that impact financial services marketing budgets

Your industry will affect how you approach your budget, including how much you spend and what you spend it on to succeed. Here are the leading factors impacting your 2025 marketing budget for financial services:

- Internal resources: Many financial institutions have limited internal teams, bandwidth, and expertise to handle marketing. If that sounds like your business, you might spend more of your budget outsourcing marketing than hiring a marketing team.

- Compliance needs: Regulations in the finance industry extend to how you market your services. You must have compliant marketing to avoid penalties and other ramifications.

- Customer acquisition costs (CAC): With rising CACs, you might look to new channels and solutions to help you increase your number of clients without wasting your budget.

- Adapting to industry trends: Digital marketing changes constantly, and it’s important to keep up with those changes and finance industry trends to maintain your success. Investing in the right strategies can help you stay competitive in your industry.

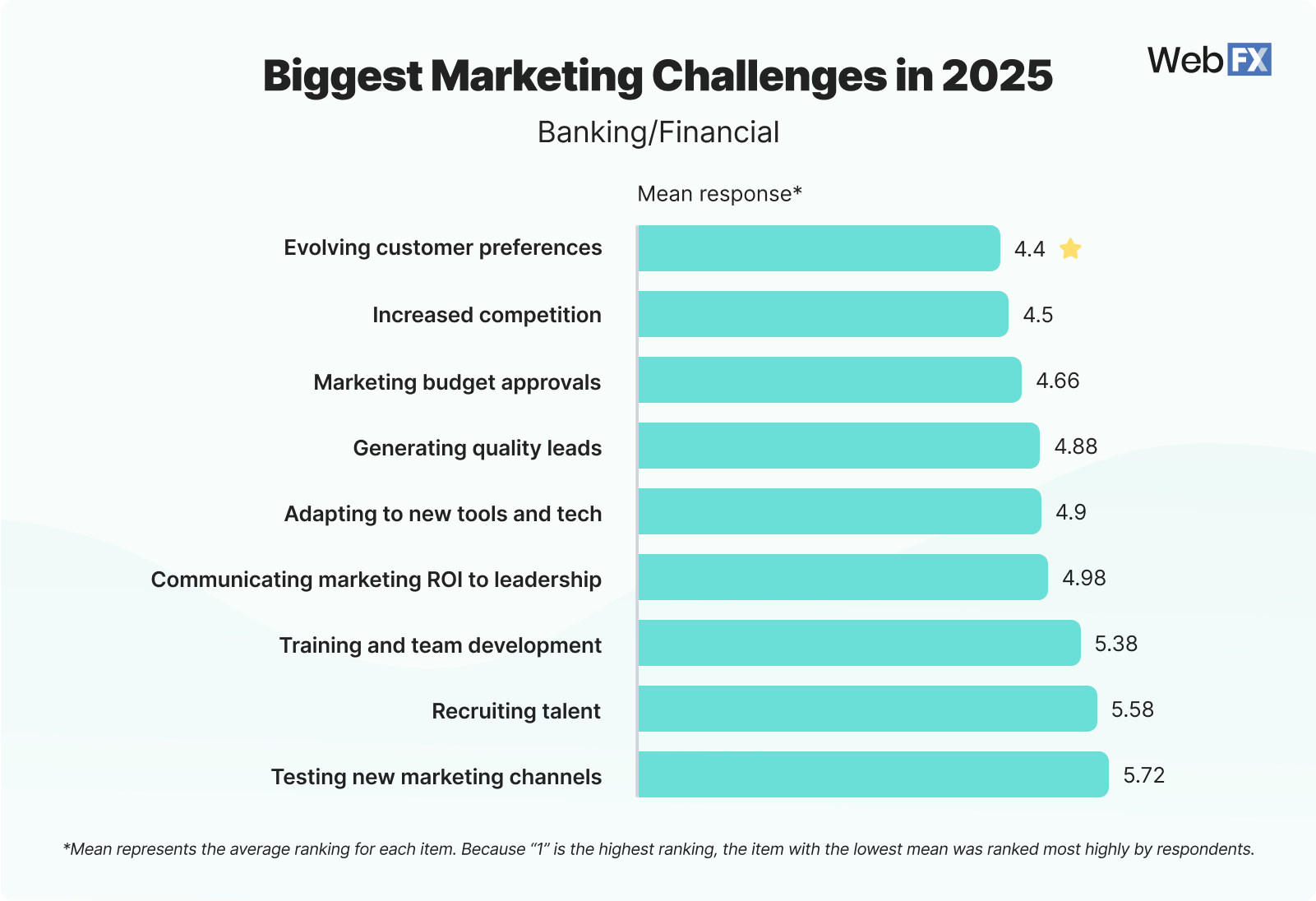

You can also look at the biggest marketing challenges in your industry:

How to create a financial services marketing budget

How To Create Your 2025 Financial Services Marketing Budget

- Allocate 7-10% of your total revenue for marketing

- Reserve between 5-10% of your marketing budget to invest in new marketing strategies

Once you understand what affects your marketing budget and how much to spend on average, you can start looking inward and building your own. Here are some steps to build your 2025 finance industry marketing budget:

- Outline your marketing goals

- Determine your available revenue and marketing costs

- Research the financial market and competitor strategies

- Evaluate as necessary to optimize your ROI

Learn more about each step below!

1. Outline your marketing goals

The first step to creating a marketing budget is determining what you want to accomplish. Financial companies in particular might focus on building their position in the industry and engaging with current clients.

Creating SMART goals — those that are Specific, Measurable, Attainable, Relevant, and Timely — will help you set attainable standards for your marketing budget. One SMART goal for a financial company could be “We want to increase client retention by X percent in the next 12 months.”

Here are some questions to ask yourself to evaluate your current marketing strategy and what you want to achieve:

- What do you want to accomplish this quarter/year?

- What channels currently produce the highest ROI?

- What metrics will you use to measure your success?

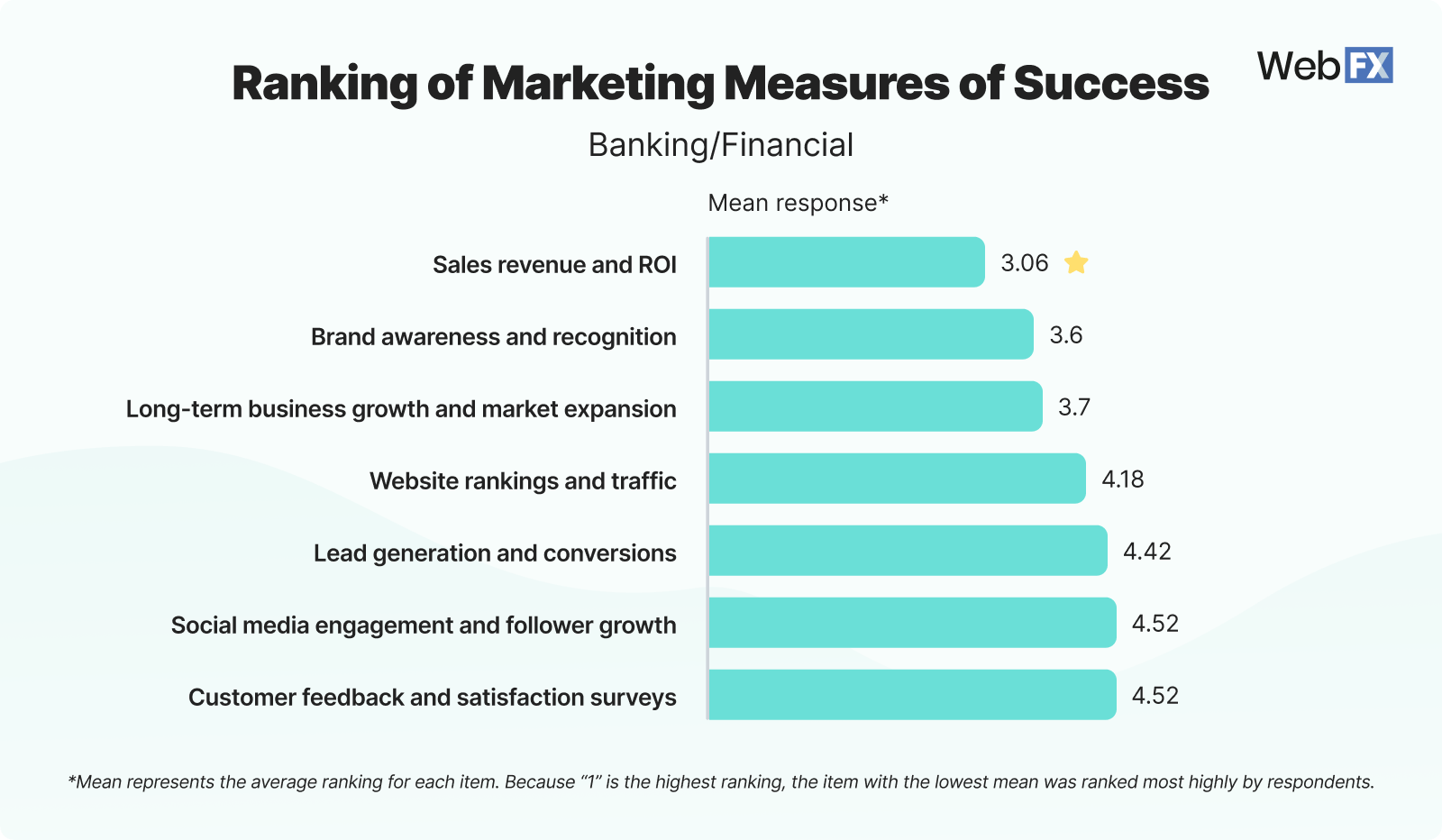

You should also consider the common measures of success within your industry to determine your goals:

2. Determine your available revenue and marketing costs

You must also determine how much revenue your company is bringing in to see how much you can afford to spend on marketing. While the industry average is 7-10%, you might spend more or less depending on your revenue, company size, and ability.

Larger financial firms might spend less since they have already established their client base. However, smaller companies might spend a higher amount to get their name out there and start finding clients. It also depends on what you can realistically afford to spend.

You also need to outline the costs you’ll face. Some examples of marketing costs include:

- The channels you invest in

- Your digital marketing provider

- Ongoing subscriptions for tools and services

- Any website upgrades and improvements

3. Research the financial market and competitor strategies

Market conditions will affect what strategies you lean into most.

If you are dealing with high interest rates, for example, you want to find a way to market around those challenges to maintain client retention and growth. You should be positioning yourself as a thought leader and providing plenty of informational content so they can learn about your financing options, accounts, credit cards, etc.

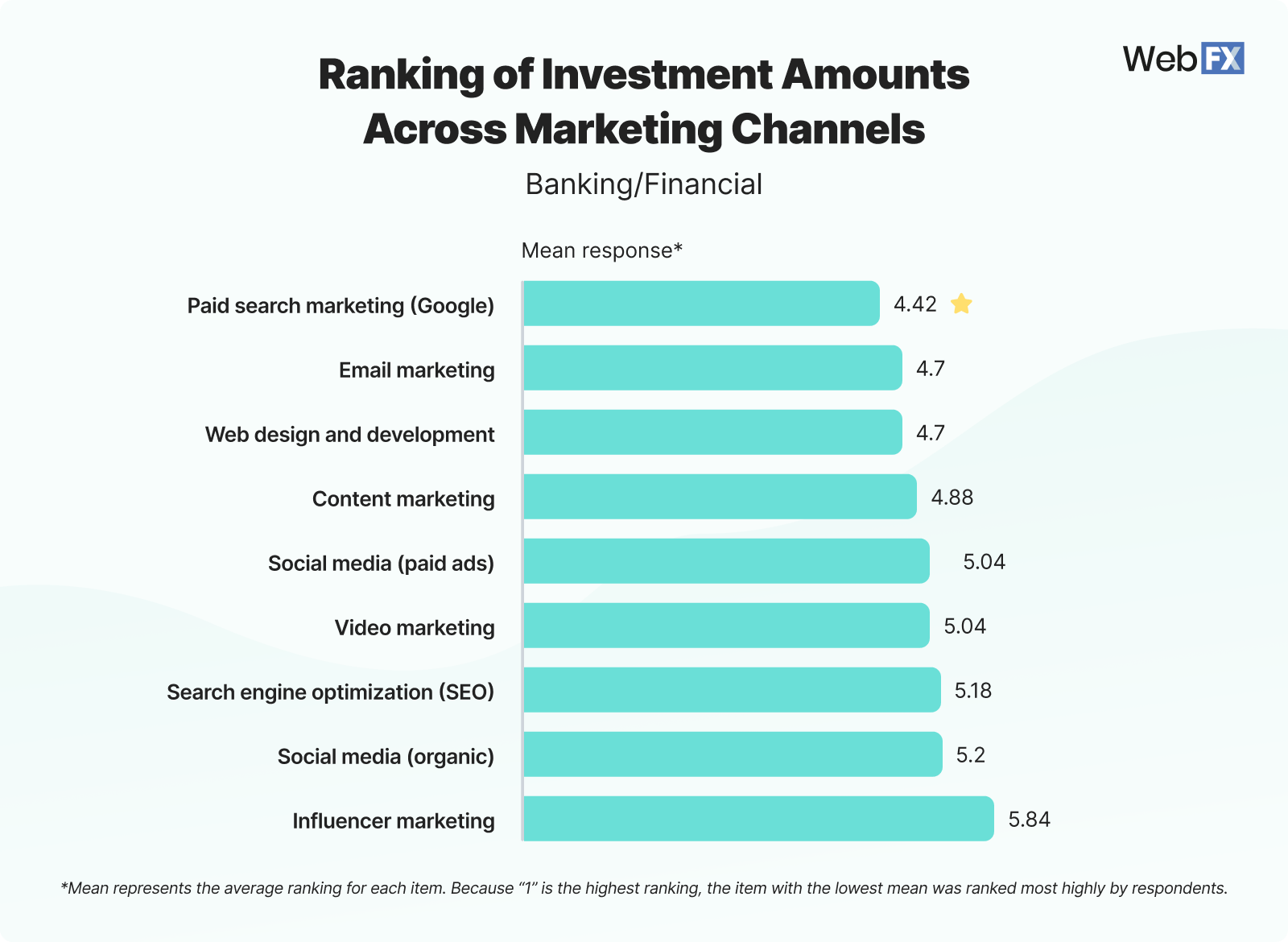

You should also analyze your competitors in your industry to see how to deal with market changes. Look at their strategies to see what others are investing in (and how those strategies can fit into your marketing):

4. Evaluate as necessary to optimize your ROI

Finally, be sure to review and adjust your budget throughout the year.

Your marketing budget will be an effective guide, but it will change as your company grows and as the financial industry changes. Any marketing budget will need to accommodate changing interest rates and regulations, as well as any new techniques or strategies.

Be sure you’re tracking your marketing channels effectively to measure what strategies work for you. Tracking which channels are performing well can help you reallocate your marketing budget accordingly for the highest ROI possible.

FAQs on financial services marketing budgets

Want to learn even more about finance marketing budgets? Check out our FAQ below!

How much should financial services companies spend on marketing?

Companies in the financial services industry should spend 7-10% of their revenue on marketing. That percentage will allow you to be competitive without over- or under-spending.

What is the average marketing budget for financial services?

According to our research, 54% of finance companies report spending between $5,000 and $10,000+ a month on digital marketing.

What is a finance marketing budget?

A marketing budget for financial services is a plan that outlines how much a company will spend on marketing over a set period. This blueprint will help your company balance cost with growth.

Some aspects of a marketing budget in finance include:

- Advertising

- Marketing staff salaries or outsourced marketing prices

- Research

- Website development and maintenance

- Marketing tools

- And more!

What is the 70-20-10 rule for marketing budgets?

The 70-20-10 rule for marketing budget divides your spending into three categories:

- 70% for proven tactics

- 20% for innovative strategies

- 10% for experimental initiatives

This setup gives your budget a nice balance between investing in proven strategies and finding new areas to try.

Turn your marketing budget into a revenue-driving plan with WebFX

If you want to take control of your marketing budget for financial services, partner with WebFX. With our help, you can turn your marketing budget into a plan for driving revenue throughout the year.

Our agency has 64,350+ hours of experience in the financial services industry, which we use to get the most revenue out of every dollar you budget for marketing. With our digital marketing services, you can build your company’s online credibility and stand out in a competitive industry.

Contact us today to see how you can boost your ROI and grow your budget YoY!

We Drive Results for Financial Companies

- Dedicated account manager backed by 500+ digital experts

- Renowned for our communication and transparency

Table of Contents

- How much do financial services companies spend on marketing?

- Financial services marketing budget breakdown

- Factors that impact financial services marketing budgets

- How to create a financial services marketing budget

- FAQs on financial services marketing budgets

- Turn your marketing budget into a revenue-driving plan with WebFX

We Drive Results for Financial Companies

- Dedicated account manager backed by 500+ digital experts

- Renowned for our communication and transparency

Explore our finance case studies

Read our case studies for more a more in-depth look at our results.

Solving key challenges for financial services

Our website isn’t driving enough traffic

Boost your online visibility in search engines, increase your rankings, and drive more traffic to your website with a team of award-winning designers, SEO specialists, social media experts, and more.

We’re not attracting new customers

Encourage your prospects to sign up for your financial services with engaging website design and a seamless user experience that encourages your website visitors to become leads or clients.

We’re not selling the new services we offer

Need help promoting your financial services? Our range of revenue-driving digital advertising and marketing services helps you get your new services in front of your target audience on the channels where they spend their time.

We’re struggling to retain clients

Implement strategies and processes that build your brand loyalty and keep your current clients satisfied and coming back time and time again with our digital marketing solutions for client retention.