Are you looking to get your financial insurance company appearing at the top of search results?

If so, pay-per-click (PPC) advertising for financial insurance is one of the best strategies for your business. This strategy will help you appear at the top of search results and drive more qualified leads for your business.

So, how can you get started with this strategy?

On this page, we’ll provide you with five tips for getting started with PPC for financial insurance companies, including:

- Optimize for relevant keywords

- Create custom landing pages

- Use ad extensions

- Test your ad copy

- Show your ads at the right time

Want to get started with PPC ads? Contact us online or call us today at 888-601-5359 to speak with a strategist about our PPC services!

What you need to know about PPC for financial services

Before getting started with PPC for financial services, it’s important to understand the regulations surrounding digital advertising for financial services.

For example, Google recommends following local, state, and national regulations for your ads. You’ll also have to adhere to stricter standards if promoting debt services, cryptocurrency, or loan modification services.

Google also prohibits advertising the following:

- Short-term loans

- Credit repair services

- Personal loans with a high APR

Keep in mind that besides advertising your financial services online, you can also use organic or unpaid ways to attract leads. Search engine optimization (SEO) and email marketing are just two examples of PPC alternatives.

Hear What It’s Like to Work With WebFX!

“WebFX provides professional, knowledgeable SEO services that can help any business. They are thorough and always provide detailed responses to help educate you on what they’re doing and why. I’ve learned a lot from WebFX and it helps me do some SEO in-house while continuing to use their services.”

Insurance Company

5 tips for PPC for financial services

Learn how to optimize your results with these tips for financial services PPC:

1. Optimize for relevant keywords

When you get started with PPC for financial insurance companies, you must first find relevant keywords for your ad. Keywords trigger your ad to appear in relevant search results. If you want relevant leads to see your ads, you must start by choosing the right key terms.

You can find relevant key terms for your PPC ads by conducting keyword research. To find keywords, use keyword research tools, like KeywordsFX, to help you find words. You can take topic ideas and plug them into one of these tools to get keyword ideas.

When you conduct keyword research, focus on long-tail keywords — keywords that contain three or more words. These keywords are best for PPC because they’re more specific, so you know the search intent behind those keywords.

Plus, they have less competition because they’re so specific, which leads to a lower cost per click (CPC). Lower CPC means you can get more from your advertising budget.

If you find multiple relevant terms for the same ad, you can use keyword ad groups to help organize your terms.

2. Create custom landing pages

A big part of PPC for financial insurance companies is creating a landing page for your ads. When someone finds your ad copy relevant, they’re likely to click on your ad. What they see next is your landing page.

When you craft a PPC ad, you must craft a custom landing page to go with it.

Many companies make the mistake of using a home page or service page as their landing page. While it may seem like a simple solution, it can be detrimental to your ad campaign.

Let’s say you’re running an ad for your financial retirement services. Now imagine someone clicks on your ad and sees your homepage. Are they going to see the information they need?

No! They’ll have to dig around your site looking for relevant information about your financial retirement services. Many of them won’t even get to that point and will bounce from your page.

Okay, so let’s say you use a service page instead. It has all the relevant information about your financial retirement services, but you know what else it has? Distractions.

From social media buttons to the navigation bar, your service page offers many distractions that can distract leads from converting. While these elements are great to have when people visit your site, they can be less than helpful when running a PPC ad.

So, the solution for this scenario is a custom landing page. With a custom landing page, you can focus on the most critical information to your audience and eliminate distractions.

To craft a successful landing page, follow these best practices:

- Implement your brand’s unique style into your landing page

- Use one prominent and descriptive call to action (CTA)

- Use visuals, but don’t overload your landing page with them

- Use one prominent and concise heading

- Implement directional cues to guide users through your landing page information

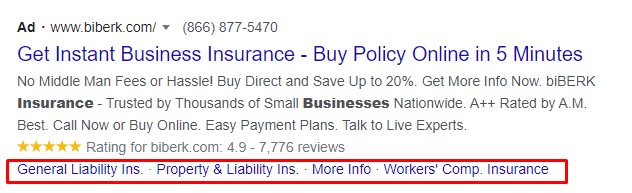

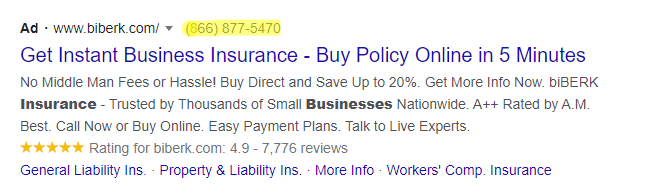

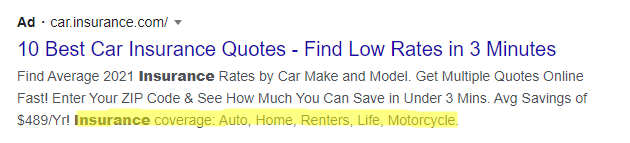

3. Use ad extensions

When you do advertising for financial insurance companies, you want to create ads that generate more clicks than your competition. To help entice your audience to click on your ads, use ad extensions.

Ad extensions provide extra tidbits of information that can entice people to click on your ad.

There are multiple types of ad extensions you can use, including:

- Sitelink extensions: These extensions enable you to add additional links to your ad.

- Call extensions: These extensions enable you to add a phone number, so prospects can call you.

- Structured snippet extensions: These extensions enable you to share information about what you offer for customers.

- Location extensions: These extensions enable you to add an address to your PPC ad.

- Callout extensions: These extensions enable you to highlight what makes your business stand out from your competition.

The best part about ad extensions? They don’t cost any extra money to add!

4. Test your ad copy

When you do financial insurance PPC, you can’t just set up your strategy and never look back at it. If you want to drive success with your PPC ads, you need to monitor your ads consistently and test them to ensure you’re putting out the best version.

By doing A/B testing, you can test different ad elements to see where you can make improvements. You can test your:

- Ad copy

- Ad extensions

- Landing page desgin

- Landing page photo choices

- Landing page directional cues

- Social proof placement

- CTA choice, color, and location

- And more

When you test your PPC ads, make sure you only test one element at a time. If you test too many elements, it will muddy the results and make it difficult to know how each aspect impacts your ad experience.

5. Show your ads at the right time

Last on our list of PPC tips are showing your ads at the right time. With advertising for financial insurance companies, your ads won’t be effective unless you show them when your audience is likely to engage with them.

So, when’s the right time to show your ads?

Well, it depends upon your audience and when they’re likely to be searching for a financial insurance company.

First, you’ll want to identify your target audience. Who are the people most likely to need your financial insurance services? Define characteristics like:

- Age

- Gender

- Occupation

- Location

- Socioeconomic status

- Family status

Since you’ll have multiple people you target, you can form buyer personas to represent these different groups. Buyer personas are fictional representations of real clients.

Once you know who you’re targeting, you can start to figure out when they’re likely to look for your services.

For example, if people who invest in your services tend to work mid-shift, it may not be best to run your ads during that time since they’re working. You may benefit more from running ads earlier in the day when they’re likely to be searching online.

When you show your ads at the right time, you’ll get more impressions and clicks on your ads.

Traffic attracted through PPC advertising yields 50% more conversions than organic advertising.

Are you leveraging PPC in your marketing efforts? Let’s get started.

View the Guide

Get started with PPC for financial insurance

When it comes to advertising for financial insurance companies, PPC is one of the best methods to help you reach more qualified leads for your business. If you aren’t sure where to start with PPC, our experts at WebFX can help.

Our team of over 500+ marketing experts is Google Ads certified, so you can feel confident you’re working with people that know every aspect of Google Ads.

Not to mention, we know how to craft campaigns that drive results. In the past five years alone, we’ve driven over $6 billion in sales and over 24 million leads for our clients.

Ready to get started with PPC for financial insurance companies? Contact us online or call us today at 888-601-5359 to learn more about our PPC services!

We Drive Results for Financial Insurance Companies

- Dedicated account manager backed by 500+ digital experts

- Renowned for our communication and transparency

We Drive Results for Financial Insurance Companies

- Dedicated account manager backed by 500+ digital experts

- Renowned for our communication and transparency

Explore our insurance case studies

Read our case studies for a more in-depth look at our results.

Solving key challenges for financial insurance

Our website isn’t driving enough traffic

Drive more qualified traffic to your website with digital marketing strategies designed to boost your online visibility and brand awareness.

We’re not attracting new clients

Keep a steady stream of clients coming through your doors with personalized marketing plans from WebFX designed to attract high-value leads to your business.

We’re struggling to sell the new services we offer

Having trouble getting prospects to invest in your new insurance services? Get your services in front of the people who are actively searching for them with WebFX.

We aren’t retaining clients

It costs more money to attract new clients than it does to retain them. Enjoy massive cost savings and more revenue with marketing plans designed to foster client loyalty and long-term relationships.